Assessing IDEXX Laboratories After a 76% Rally and Surging Pet Healthcare Demand

- Wondering whether IDEXX Laboratories is a bargain right now? Let’s break down what today’s price might mean for those looking for value or opportunity.

- Shares have soared by 14.7% in the past month and capped off an impressive 76.2% surge year-to-date, making it hard to ignore the stock’s momentum and the shifting sentiment among investors.

- Much of the recent excitement can be traced to market buzz around continued strength in the animal diagnostics sector along with growing confidence in pet healthcare trends. Both have drawn new attention to IDEXX Laboratories. News of increasing pet ownership and veterinary spending in North America has added fuel to the company’s already rising profile this year.

- But when it comes to valuation, IDEXX Laboratories scores just 0/6 on our checklist of undervalued factors, which may surprise some. Next up, we will unpack the valuation methods that help us arrive at that score. Later in the article, we reveal a more powerful approach to truly understanding a company’s worth.

IDEXX Laboratories scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: IDEXX Laboratories Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular valuation technique that estimates a company’s value by projecting its future cash flows and then discounting those figures back to today’s value. This approach helps investors understand what a business is truly worth, based on its ability to generate money over time.

For IDEXX Laboratories, the starting point is its latest annual Free Cash Flow of $933.5 million. Analysts have provided cash flow projections for the next five years, with 2029’s estimated Free Cash Flow reaching approximately $1.68 billion. After that, further growth is extrapolated using established trends by Simply Wall St to complete a ten-year outlook.

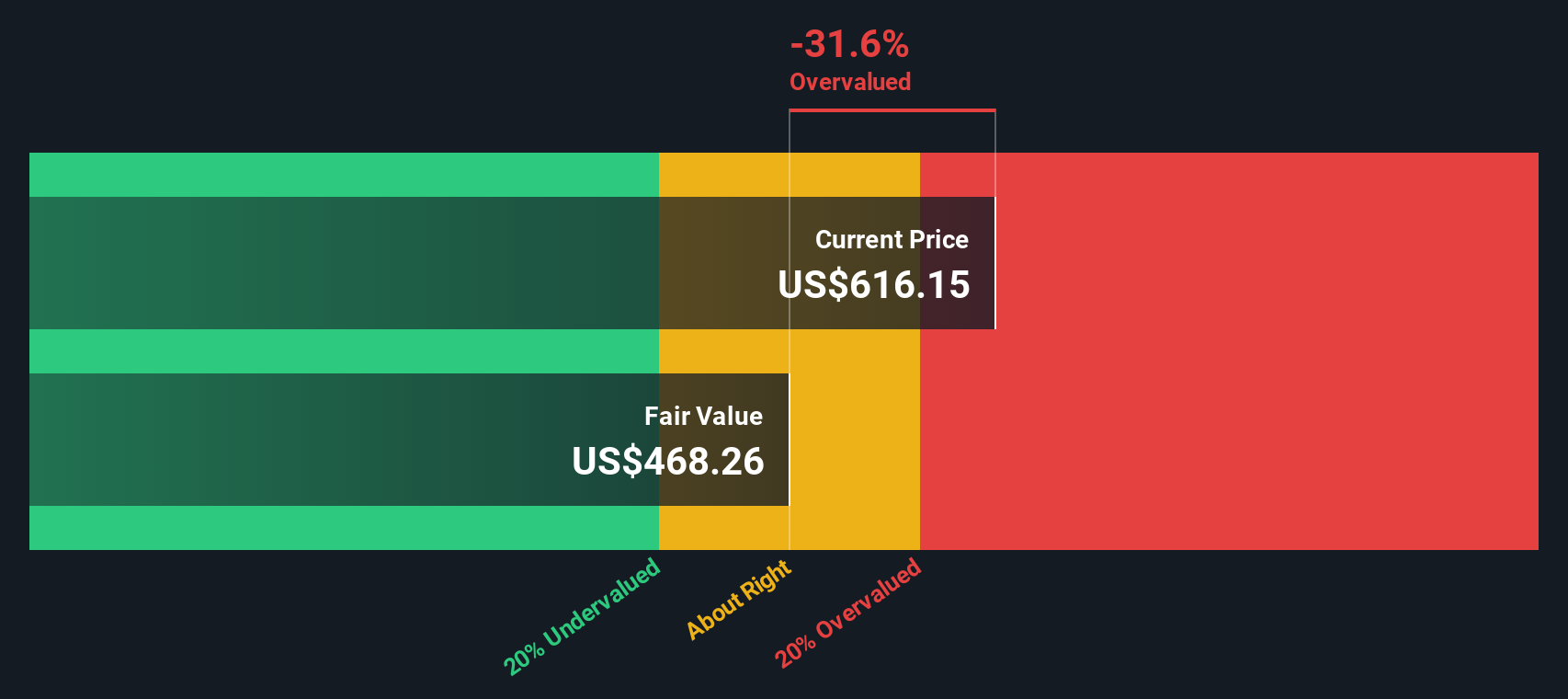

All valuation calculations use dollars as the reporting currency. The DCF analysis, based on a 2-Stage Free Cash Flow to Equity model, calculates IDEXX Laboratories’ intrinsic value at $492.60 per share. Comparing this to the current market price, IDEXX appears to be 46.2% overvalued by this measure.

A DCF model suggests that the current share price is running well ahead of what the company’s future cash flows justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests IDEXX Laboratories may be overvalued by 46.2%. Discover 849 undervalued stocks or create your own screener to find better value opportunities.

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for IDEXX Laboratories.

Approach 2: IDEXX Laboratories Price vs Earnings

For profitable companies like IDEXX Laboratories, the Price-to-Earnings (PE) ratio is a go-to valuation metric. It lets investors quickly gauge how much the market is willing to pay today for a dollar of the company’s earnings, making it especially useful for established businesses generating consistent profits.

It’s important to remember that what counts as a “normal” or fair PE ratio depends on a company’s growth prospects and risk profile. Generally, companies with higher expected growth or lower risk tend to command higher multiples, while slower-growing or riskier businesses trade at a discount.

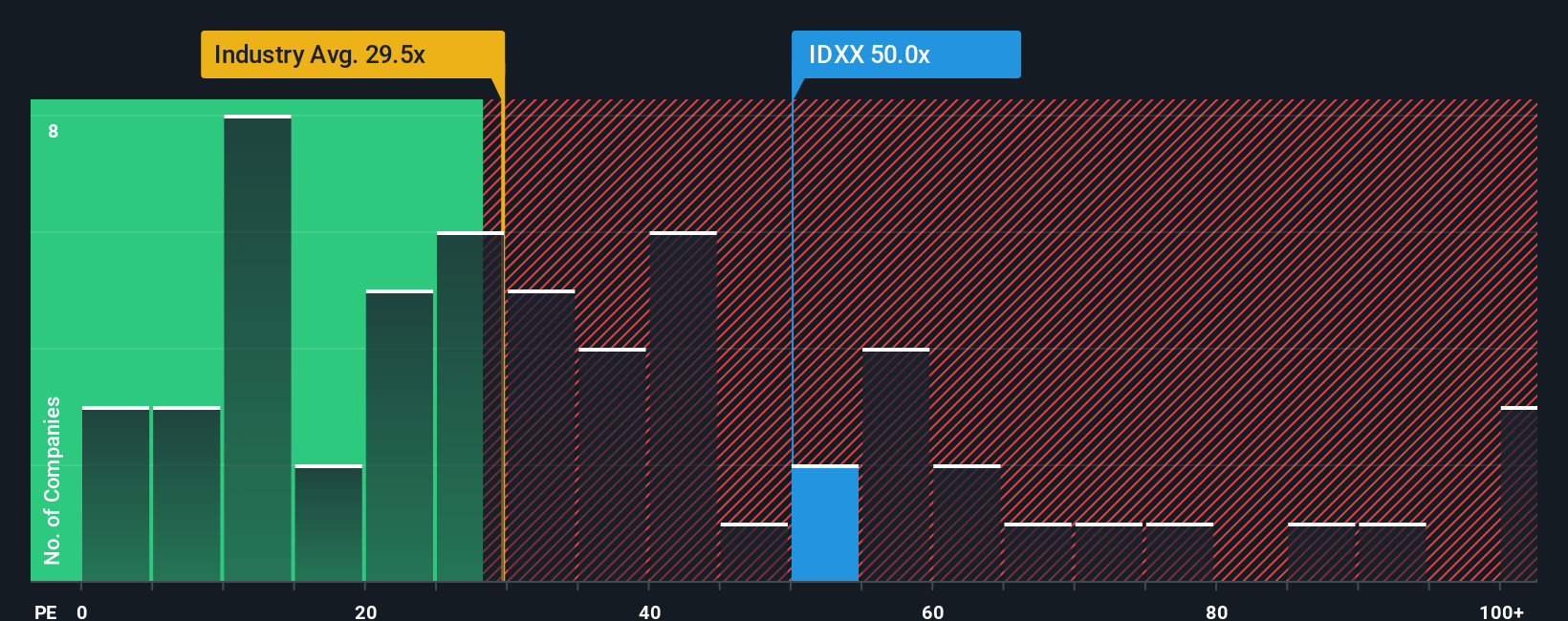

IDEXX Laboratories currently trades at a PE ratio of 56x. That is nearly double the Medical Equipment industry average of 29x and also well above its peer group average of 27x. At first glance, this premium might raise eyebrows. However, Simply Wall St’s proprietary “Fair Ratio” offers a more nuanced benchmark. For IDEXX, the Fair Ratio is 31.4x. This metric goes beyond peers and industry averages by taking into account critical factors like IDEXX’s earnings growth, profit margins, market cap and business risks.

The Fair Ratio provides a tailored benchmark, helping investors avoid overpaying for mere hype or overlooking genuine quality. In this case, IDEXX’s actual PE ratio of 56x sits significantly above its Fair Ratio of 31.4x, suggesting the shares may be priced for more than perfection.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your IDEXX Laboratories Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story about IDEXX Laboratories, built from your own perspective on its future, including what you believe are the company’s fair value, future revenue, earnings, and profit margins.

Narratives connect your view of the company’s story, including how you see its business strengths, growth drivers, or risks, to a financial forecast and then to a concrete fair value. This approach helps you make investment decisions with more context and confidence. On Simply Wall St’s Community page, millions of investors are using Narratives as a simple, accessible tool for building, tracking, and comparing these personalized perspectives.

With Narratives, you can easily decide when it is time to buy or sell by comparing your calculated Fair Value to the current market Price. Because Narratives are updated automatically whenever new information like earnings releases or news emerges, your analysis stays relevant without constant manual effort.

For example, one investor’s Narrative for IDEXX Laboratories might highlight the company’s expanded presence in international diagnostic markets and high-margin cloud solutions, resulting in a bullish fair value close to $785. In contrast, another, more cautious Narrative might focus on slowing U.S. clinical visits and rising competition, setting their fair value at just $420.

Do you think there’s more to the story for IDEXX Laboratories? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

link