The pet healthcare and food industry is expected to enter a phase of accelerated growth. Attention should be paid to high-potential quality brand owners and contract manufacturers.

The leading players in China’s pet health food market are primarily specialized pet health food companies, with equal opportunities for all and the potential for disruptive growth.

According to Zhitong Finance, Dongwu Securities issued a research report stating that with an increasing number of pets, higher-quality pet owners, and stronger awareness of pet healthcare, 2027 could be a significant turning point for the pet health supplement industry. The sector is expected to enter a period of accelerated growth, which deserves attention. Considering differences in product categories and regulatory frameworks, the report suggests that profit margins for pet health supplements could reach higher levels: in 2024, the average gross margin for human health supplements is 60-70%, while for pet health supplements it generally ranges from 70-90%. It recommends focusing on high-potential premium brands and contract manufacturers.

The main points of Dongwu Securities are as follows:

Pet health supplements, which support health maintenance and offer optional upgrades, share certain similarities with the human health supplement industry.

Pet health supplements, which support health maintenance and offer optional upgrades, share certain similarities with the human health supplement industry.

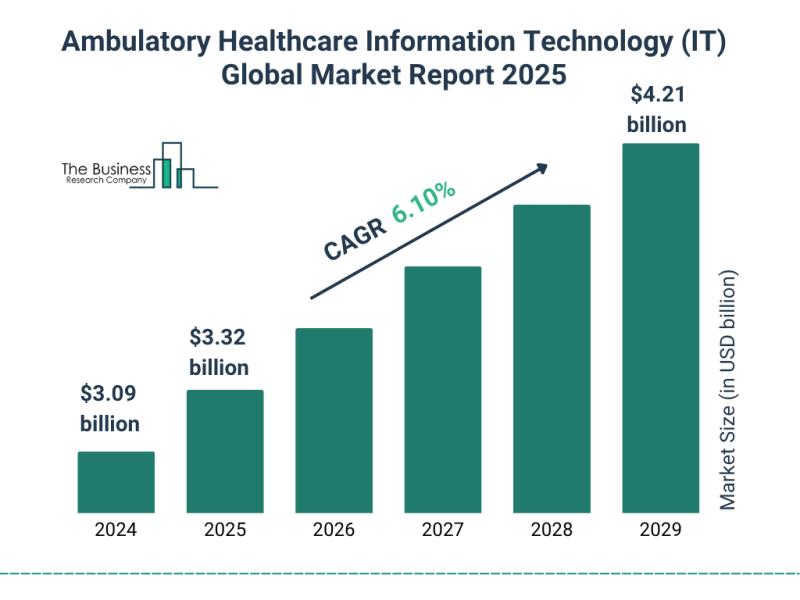

Pet health supplements fall between pet food and pet pharmaceuticals, offering functional benefits and being consumed at medium to high frequencies. As an optional upgrade consumption category, this segment shows strong potential: (1) From 2020 to 2024, the compound annual growth rate (CAGR) of pet health supplement spending was 13%, reflecting robust demand; (2) This growth rate exceeded the increase in per capita disposable income and per capita GDP during the same period, indicating that pet health supplements belong to the discretionary consumption upgrade category. As disposable income rises, consumers are increasingly willing to spend on their pets’ health. From an industry chain perspective, pet health supplements can be divided into upstream raw material suppliers, midstream contract manufacturers, and downstream brands and retail outlets, each playing a distinct role. Among these, raw materials, contract manufacturing, and terminal distribution channels share some commonalities with the human health supplement industry.

The Pet Health Supplements Industry: A Rising Sun with Steady Growth

(1) Number of pets: According to Nielsen GFK Consumer Life, as of 2024, China has approximately 1.24 billion pet cats and dogs, including 0.72 billion pet cats and 0.53 billion pet dogs. Compared to the United States, China’s pet ownership rate has significant room for growth: household pet penetration in China has potential to increase 3-4 times, while per-pet annual spending has potential to grow 5-6 times; (2) Pet health supplements industry: In 2024, the scale of China’s pet health supplements industry is approximately RMB 1.522 billion, with a CAGR of 13% from 2020 to 2024. By the end of 2024, pet health supplements accounted for 40% of pet health products, representing a 0.8 percentage point increase from 2020. Looking ahead, with more pets, better-quality pet owners, and stronger awareness of pet health care, the report believes that 2027 may be a key inflection point for the pet health supplement industry, which could enter a phase of accelerated development and deserves attention.

Referencing Human Health Supplements: Verticalization and E-commerce May Be Future Trends

(1) Reviewing the evolution of human health supplements, the industry has progressively shifted from general health products toward precision nutrition. Trends in pet supplements typically lag behind those in human supplements by approximately six months to a year, suggesting that developments in the human sector may serve as useful references for the pet sector; (2) Core sales channels for human health supplements have evolved through three phases: direct sales, pharmacies, and e-commerce (the first two stages were dominated by offline channels), and the transition to online sales for pet supplements is currently underway; (3) Considering differences in product categories and regulatory frameworks, the report suggests that profit margins for pet health supplements may reach higher levels: in 2024, the average gross margin for human health supplements is 60-70%, whereas for pet health supplements, it typically ranges from 70-90%.

Reference from overseas: China’s diversified channels and equal opportunities

(1) The United States represents the most mature market for pet health food globally, with an estimated 73.8 million cats and 89.7 million dogs kept as pets in 2024. Breaking down the age structure of pet owners, Chinese pet owners exhibit a clear trend towards being younger, with emotional needs outweighing functional ones; (2) Traditional offline retail remains the mainstream channel for the pet care industry in the U.S., whereas in China, benefiting from the development of e-commerce, online channels have rapidly increased in share and have become the dominant sales avenue. This evolution mirrors that of human health food channels. In 2022, 86% of consumers purchased pet health food through comprehensive e-commerce platforms, 52% via specialized pet healthcare apps, 32% on short video platforms, and 16% through social media platforms; (3) Due to differences in channel structures, regulatory frameworks, and expansion methods, fast-moving consumer goods (FMCG), pet food, and pet healthcare companies perform better in the U.S. pet health food market. In contrast, leading players in China’s pet health food market are primarily specialized pet health food enterprises, offering equal opportunities for new entrants to overtake traditional leaders.

Focus on high-quality brand operators and contract manufacturers with significant growth potential

The bank believes: ① Specialized enterprises (e.g., Chongxin, Hongrui) possess strong market foundations and have completed the transition from offline to online channels. Through category innovation and deep channel engagement, they are poised for substantial growth; ② Overseas brands such as Zesty Paws will find localization of production essential, and it is recommended to monitor H&H International Holdings’ strategic moves in the pet health food sector; ③ Meanwhile, contract manufacturers, leveraging their production efficiency and R&D capabilities, are well-positioned to meet this growing demand. For both new entrants and large enterprises requiring frequent product launches, the role and influence of contract manufacturers are expected to increase significantly. It is suggested to pay attention to publicly listed contract manufacturers with forward-looking investments in pet health food, such as Sirio Pharma and Baihe Corporation.

Risk Warning: Risks associated with market competition, rising raw material costs, and lower-than-expected product sales.

link