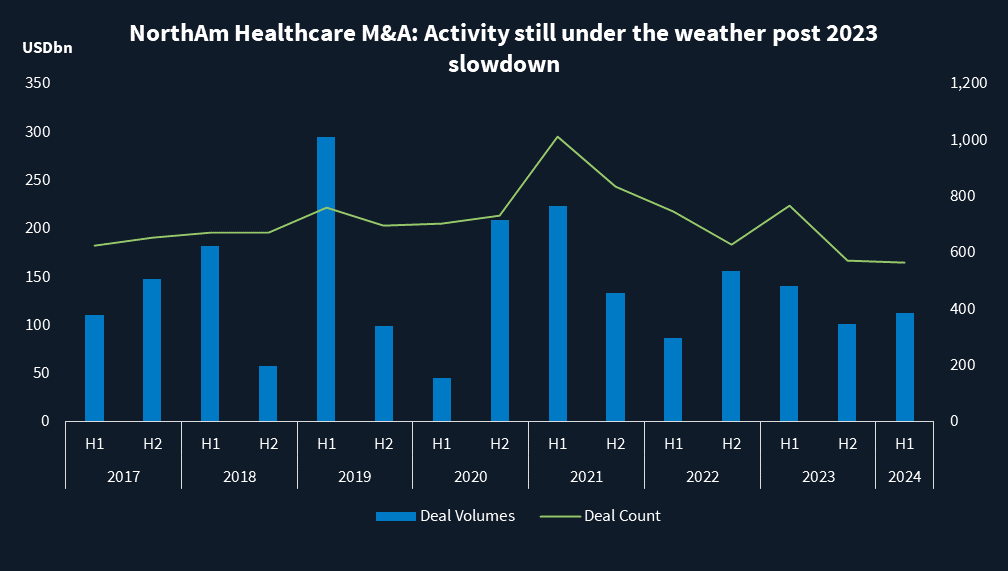

The North American healthcare sector saw deal value drop more than 20% to USD USD 112bn from USD 140bn, and the number of deals drop 26% year-over-year to 565 from 768 from 1H23 to 1H24, according to Mergermarket data.

Although M&A continues to face macroeconomic headwinds such as inflation, interest rate uncertainty and an impending election, healthcare dealmakers are seeing a strong appetite from buyers, signaling an optimistic outlook for 2H.

In the sector – comprising pharma and biotech, healthcare services, information technology and medtech –biomed/genetics and pharmaceuticals each totaled USD 40bn and together made up the lion’s share of total deal value for 1H24.

Source: Mergermarket

Both strategics and financial sponsors are ready to execute on deals across subsectors. Pharmaceutical and biotech players are seeking M&A to build their portfolios, while there is healthy buyer interest for well-run assets in healthcare services, added several dealmakers.

“M&A market fundamentals continue to improve, and we are seeing an increase in both financial sponsor and strategic buyer engagement as compared to earlier in the year; not only in terms of the number of buyers engaging on specific situations but also in the breadth of categories they are interested in evaluating,” says Ryan Bell, managing director at Moelis. “We believe the market has reached an inflection point as there is a growing list of high-quality companies in healthcare services and technology that have received broad interest and achieved premium results,” Bell adds.

Notable multi-billion-dollar deals this year include ONO Pharmaceutical [OTCMKTS: OPHLY] acquiring Deciphera Pharmaceuticals and Vertex Pharmaceuticals [NASDAQ: VRTX] acquiring Alpine Immune Sciences.

“There have been a number of multi-billion-dollar pharmaceutical transactions so far this year and the deal activity is expected to continue” through 2H, says Dan Lepanto, senior managing director at Leerink Partners.

“Biotechs will continue to explore triple track processes by running all three paths simultaneously to get the best value,” predicts Alan Zoccolillo, chairman of Baker McKenzie’s North American Transactional Practice. The three paths are: obtaining more funding for clinical development on their own; partnering via licensing and collaborations; and IPOs or M&A deals. Pharma companies are responding to these triple track processes by offering multiple deal structures such as licensing deals or acquisition, he says.

Pharma deals will get a strong reception because a limited number of assets are coming to market, says Zoccolillo. The patent cliff –which refers to a company’s revenues potentially “falling off a cliff” when an approved drug or treatment goes off-patent– and the loss of exclusivity for drugs currently on the market continues to fuel pharmaceutical and biotech M&A, adds an industry banker.

“High premiums are being paid for oncology, CNS disorders, inflammatory diseases, diabetes/weight loss,” says Zoccolillo.

“GLP-1 drugs, which are used to treat diabetes and weight-loss, have seen unprecedented growth as large pharmaceutical players race to build or enter the space,” says Lorenzo Paoletti, managing director of Biotech Investment Banking at Truist Securities. He points to Eli Lilly [NYSE: LLY] and Novo Nordisk [NYSE: NVO] as the most active acquirers of weight-loss drugs including molecules and modalities outside of GLP-1s, which are used in the blockbuster drugs Ozempic and Wegovy.

Dealmakers also expect more take-private transactions as the cost of compliance and the material impact on earnings can negatively affect the performance of public companies. Additionally, the focus on quarterly earnings can cause companies to compromise strategic decisions.

Source: Mergermarket

Healthcare information technology (HCIT) continues to see interest from both private equity and strategics with Mergermarket reporting on numerous assets on the block including IllumiCare, Lumeon, GeBBS Healthcare Solutions, Centauri, MediQuant, Accuity Delivery Systems and VisiQuate.

2H will be game time for strong assets that were waiting on the sidelines to trade, according to another industry banker. Healthcare services deals are trading at or above the peak multiples of 2020-2021, adds the banker.

For healthcare services, technology focused assets are commanding up to 20X EBITDA while services assets are in the mid to high teens EBITDA range, notes the second industry banker.

“Generative AI will also likely continue to play a major role in activity as companies look to AI solutions to help expedite drug discovery,” adds Baker McKenzie’s Zoccolillo.

link