State of Health Tech 2023

It’s hard not to have a “glass half empty” view of the health tech market—after all, the sector’s recent public market performance has been underwhelming, and its venture capital funding is projected to fall 65% from its $29 billion peak in 2021 to about $10 billion in 2023. But don’t mistake a cyclical market correction and performance of a cohort of companies as a sign of the industry’s long-term potential.

Technological innovation in healthcare hit an inflection point around 2010, in response to two major U.S. policy overhauls: the 2008 Health Information Technology for Economic and Clinical Health Act (HITECH Act) and the 2010 Patient Protection and Affordable Care Act (PPACA). It wasn’t until a few years ago that we saw the cohort of companies born in the early 2010s make it to the public markets. Private health tech venture funding grew alongside this public cohort. By the end of 2023, health tech venture funding is set to be six times greater than funding in 2012.

Like any maturing industry, there are changes needed to build a resilient future for healthcare innovation. We study the public cohort of companies, not because we are public market experts, but rather to identify lessons and insights that early and growth stage founders, operators, and investors can apply in the health tech industry’s evolution toward strong business fundamentals and effective care delivery and outcomes.

At Bessemer, we are optimistic that the health tech industry has the necessary elements for a successful future: resilient founders, patient capital (in venture, private equity, strategic and public markets), and a $4 trillion market opportunity with unsustainable cost trends that requires business model innovation and application of technology. In our first annual State of Health Tech report, we share an overview of the sector’s 2023 performance, industry benchmarks and best practices, and emerging predictions for 2024.

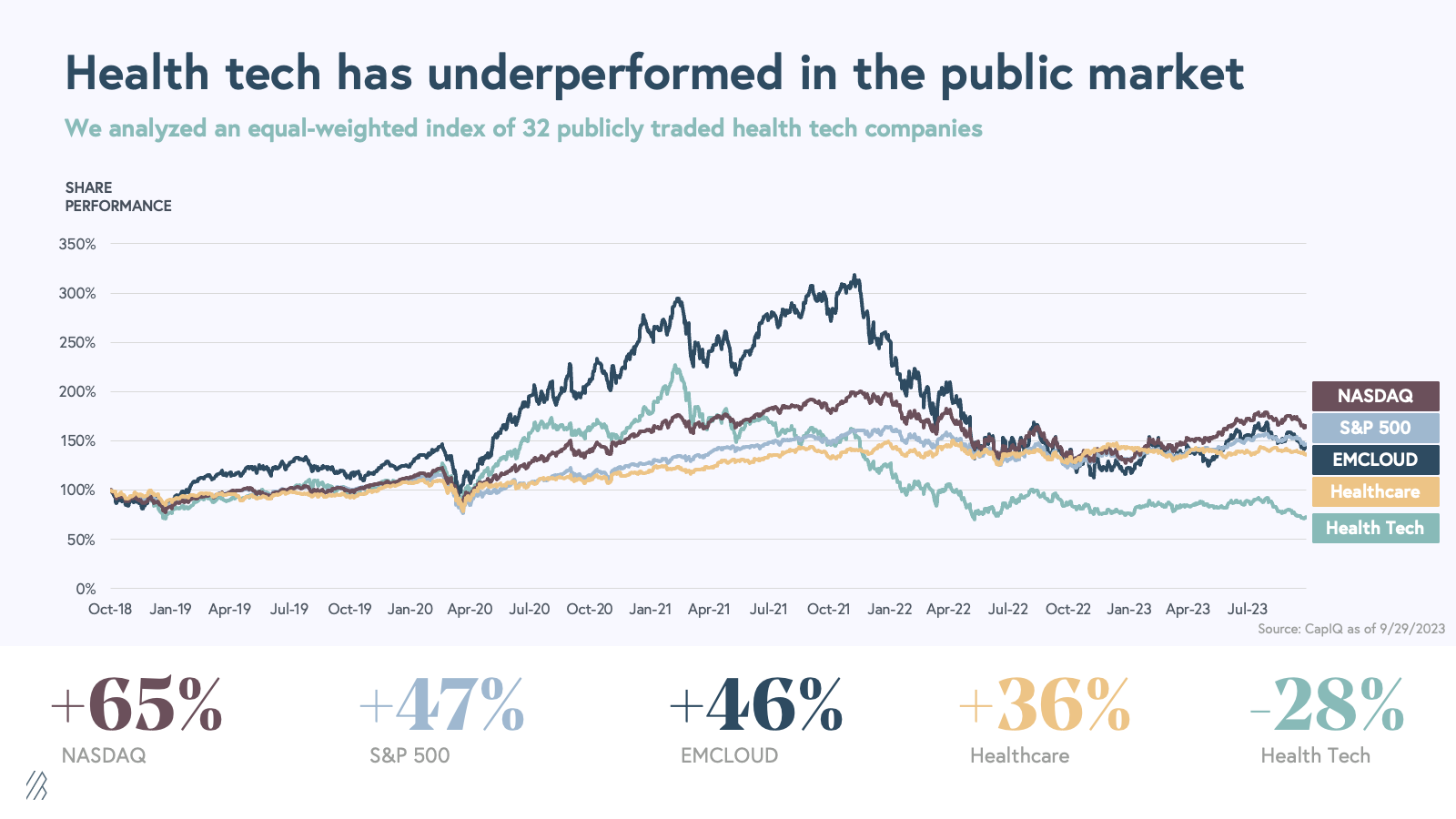

Over the past five years, publicly traded health tech companies have underperformed major market indices, painting an underwhelming picture of our sector. Public health tech companies have experienced an average share price decline of 28% since 2018, whereas Nasdaq, S&P 500, and BVP Nasdaq Emerging Cloud Index companies, as well as publicly traded legacy healthcare players, have all appreciated in average share price over the same period.

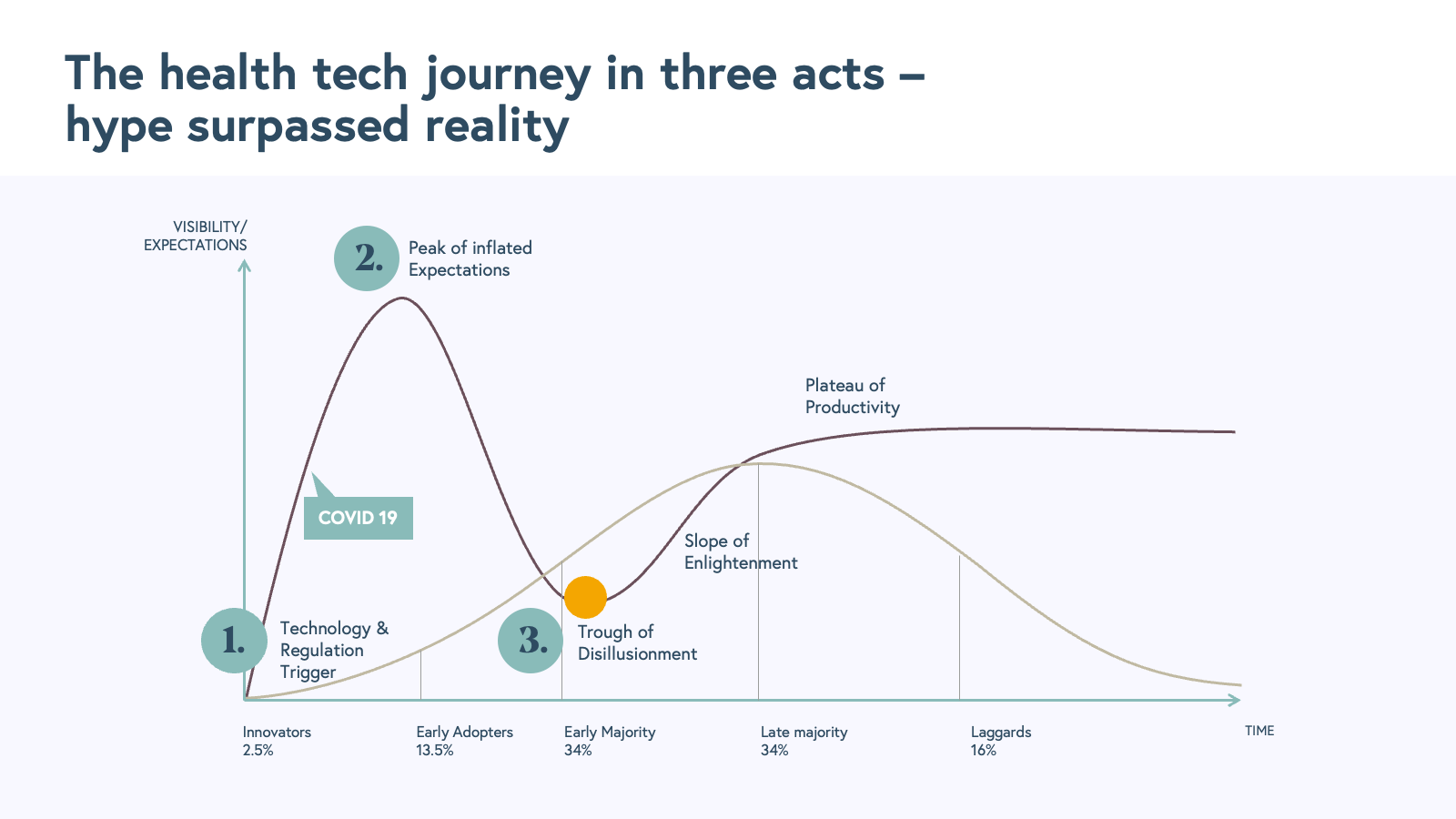

But we think there is more to the story than underperformance. The past few years of health tech public market activity suggest the industry experienced a “hype cycle.”

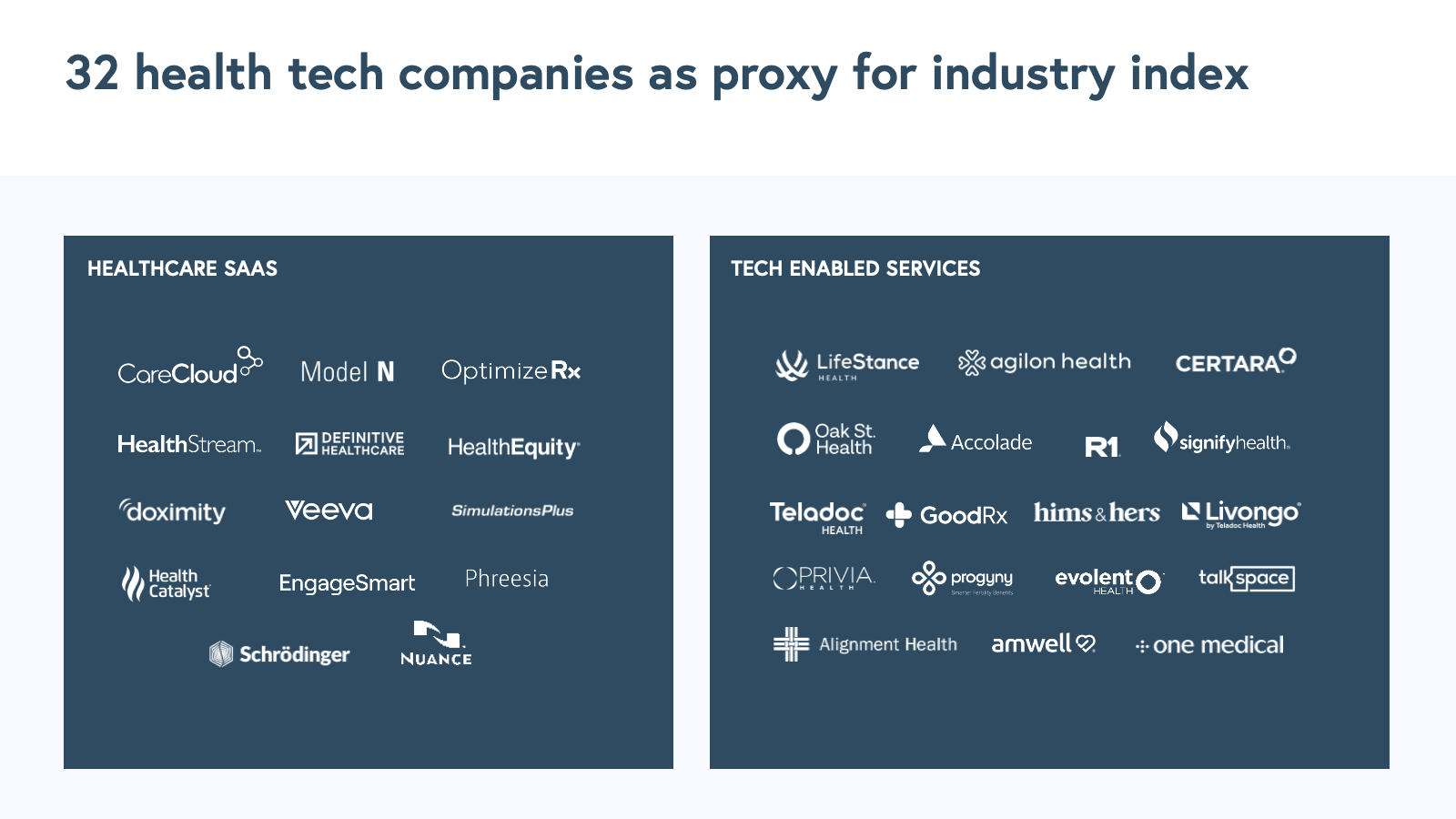

To measure health tech market performance, we studied a cohort of 32 publicly traded health tech companies, including both healthcare SaaS and tech-enabled services businesses, as part of our benchmarking efforts. (Read our previous health tech benchmarking reports here and here.)

Between 2018 and 2023, health tech company stocks rose, fell, and began to stabilize in a new valuation environment. This behavior followed three phases typical to a hype cycle: (1) the technology and regulation trigger, (2) the peak of inflated expectations, and (3) the trough of disillusionment.

Phase 1: Technology and regulation trigger

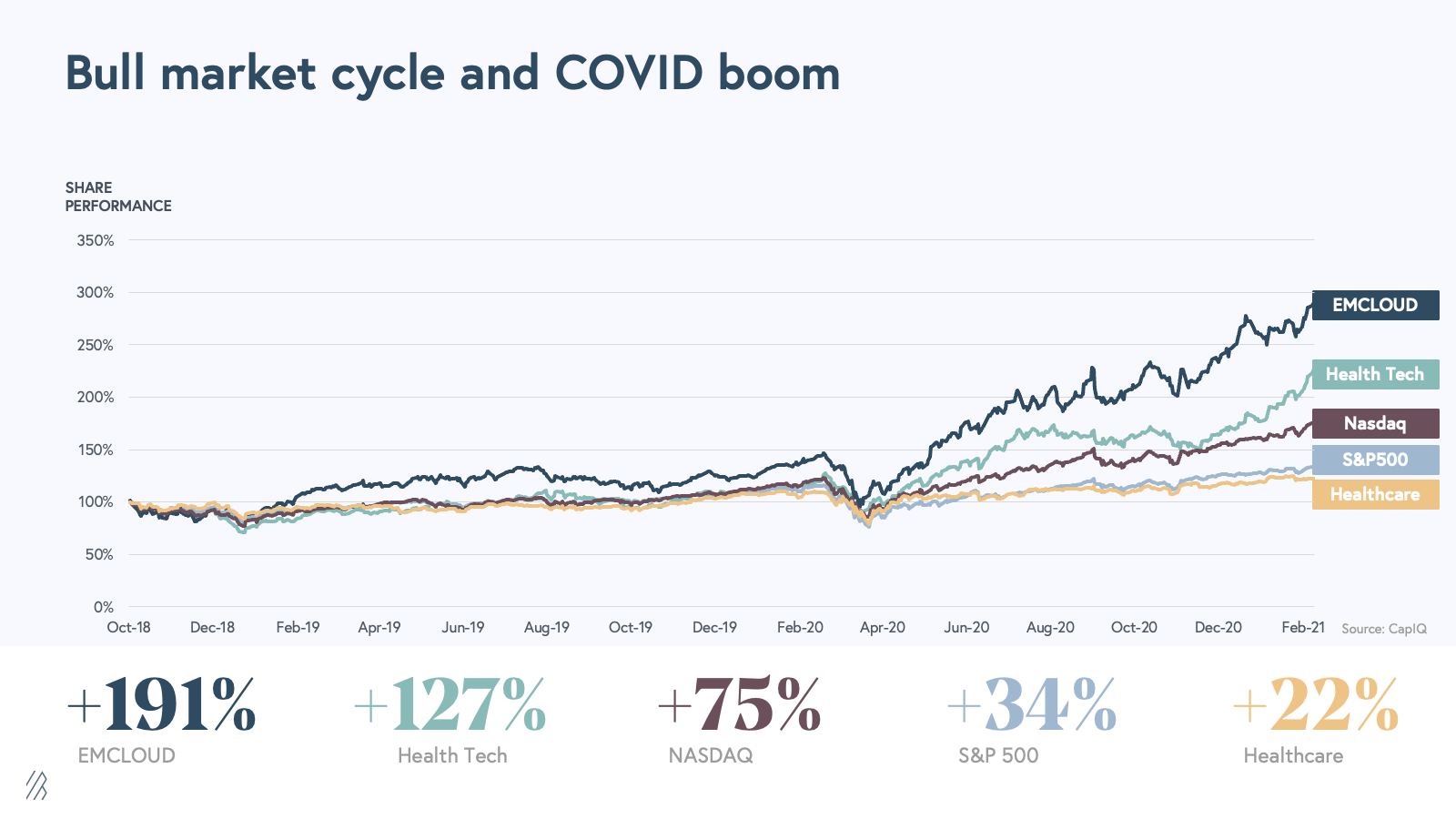

Over 50% of companies in the health tech cohort we studied were founded in the 2010s, triggered primarily by changes in regulation and the adoption of cloud technology. This first cohort of “digital health” companies took the better part of a decade to mature to the scale where they could access the public markets, which coincided with the last bull market. The COVID-19 pandemic added fuel to the fire, exposing key gaps in infrastructure and care delivery that health tech innovators rushed to improve. COVID drove a large increase in the share prices of the health tech companies we studied, with the cohort reaching peak valuation in February 2021.

Phase 2: Peak of inflated expectations

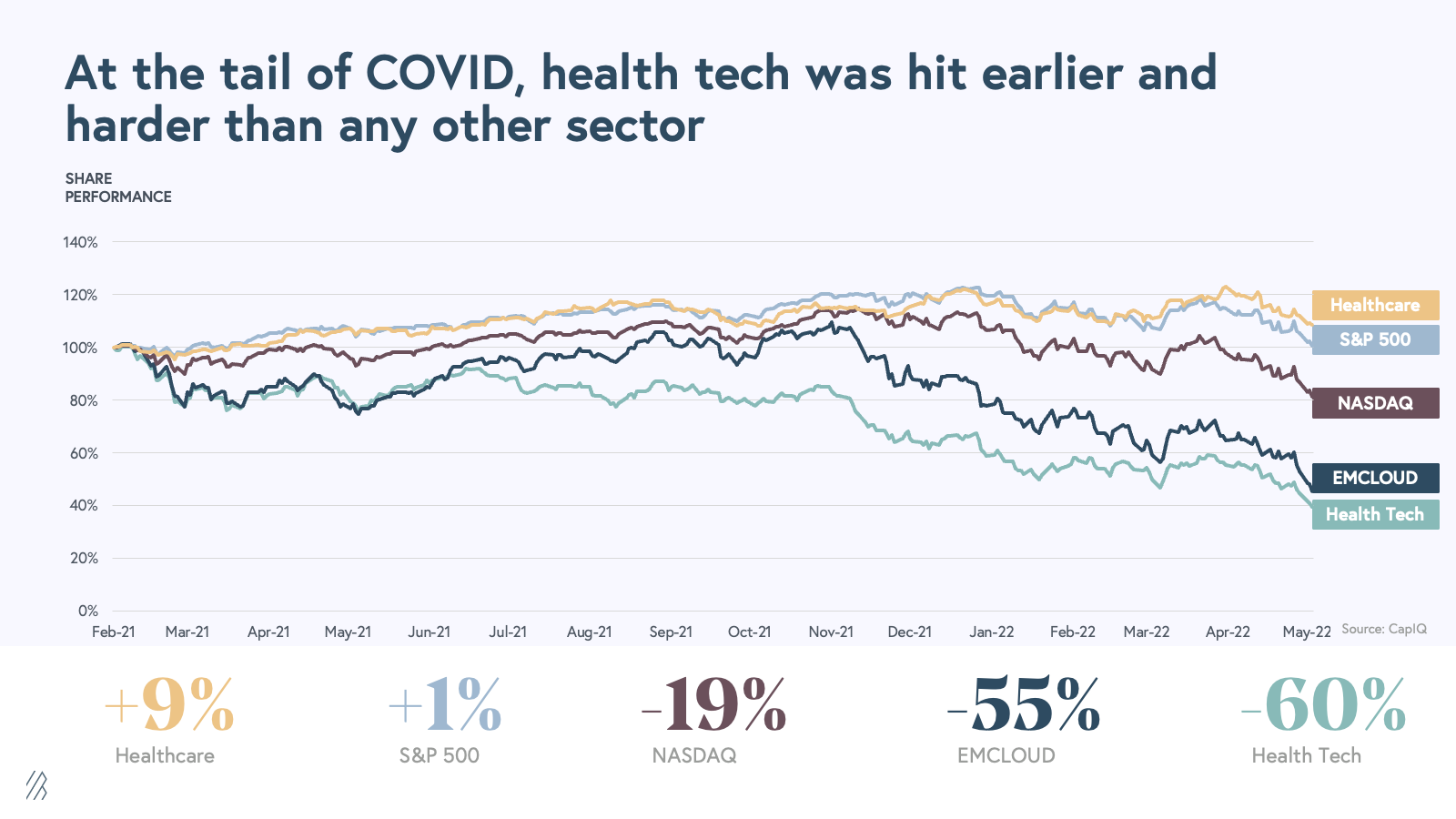

Beginning in February 2021, health tech experienced a major decline, correcting for the public market exuberance during the early stages of the pandemic. From the peak in 2021 to the trough starting in May 2022, on average, health tech stocks lost 60% of value. However, health tech stocks were not alone as high-growth companies generally were hammered in the public markets as evidenced by the emerging cloud software index declining at roughly the same rate.

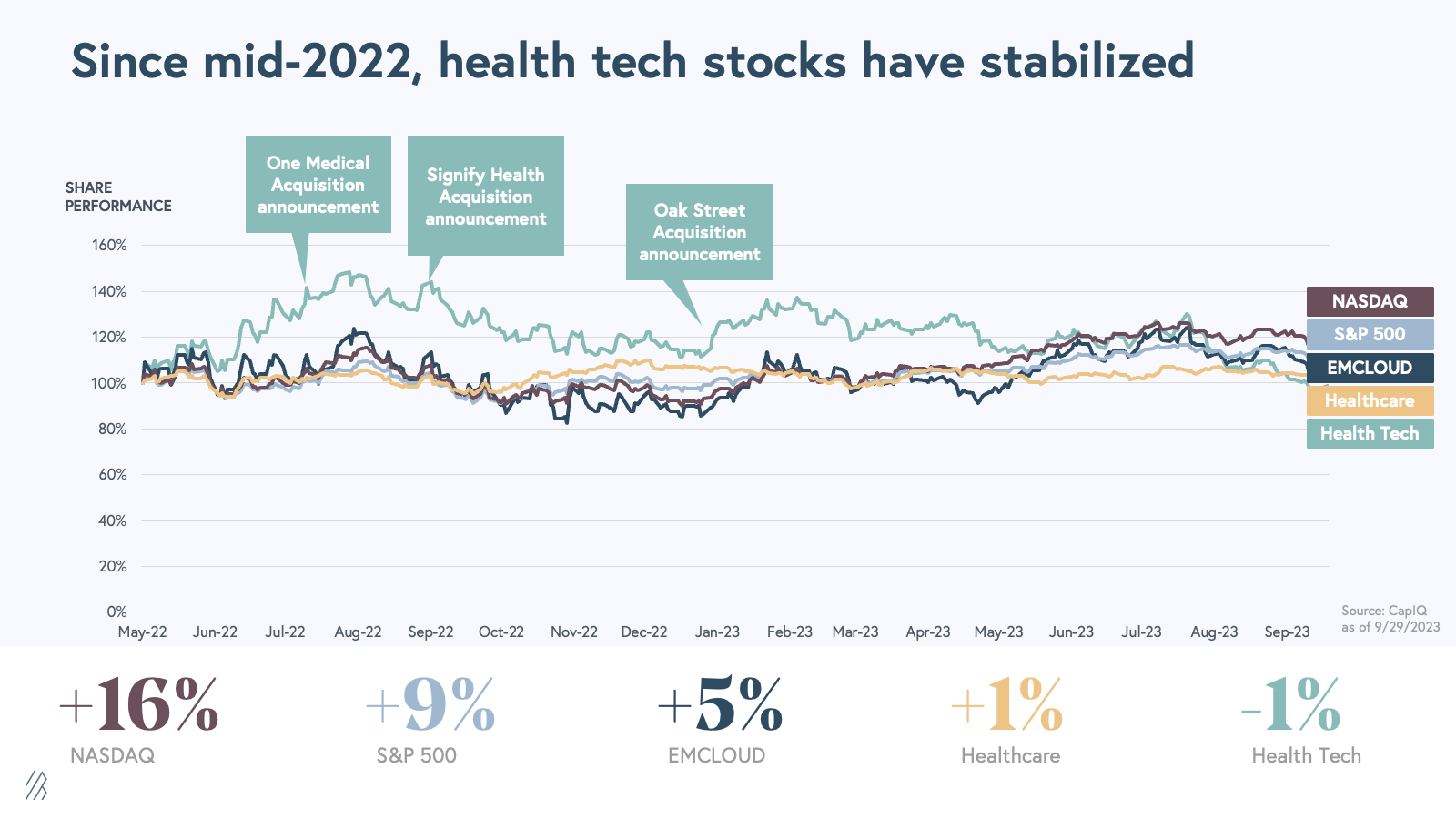

Phase 3: Trough of disillusionment

Since hitting bottom in May 2022, we’ve seen more stable performance across health tech stocks. The health tech cohort gains during summer of 2022 and January 2023 were mainly driven by announcements of relatively large acquisitions in the health tech sector, including Amazon’s $3.9 billion acquisition of One Medical, CVS Health’s $8 billion acquisition of Signify Health, and CVS Health’s $10.6 billion acquisition of Oak Street Health. We believe we are currently in the health tech public market’s trough—dare we call it the bottom of the market (!)—and we have seen health tech stocks stabilize, mirroring the recent rebound of other major market indices.

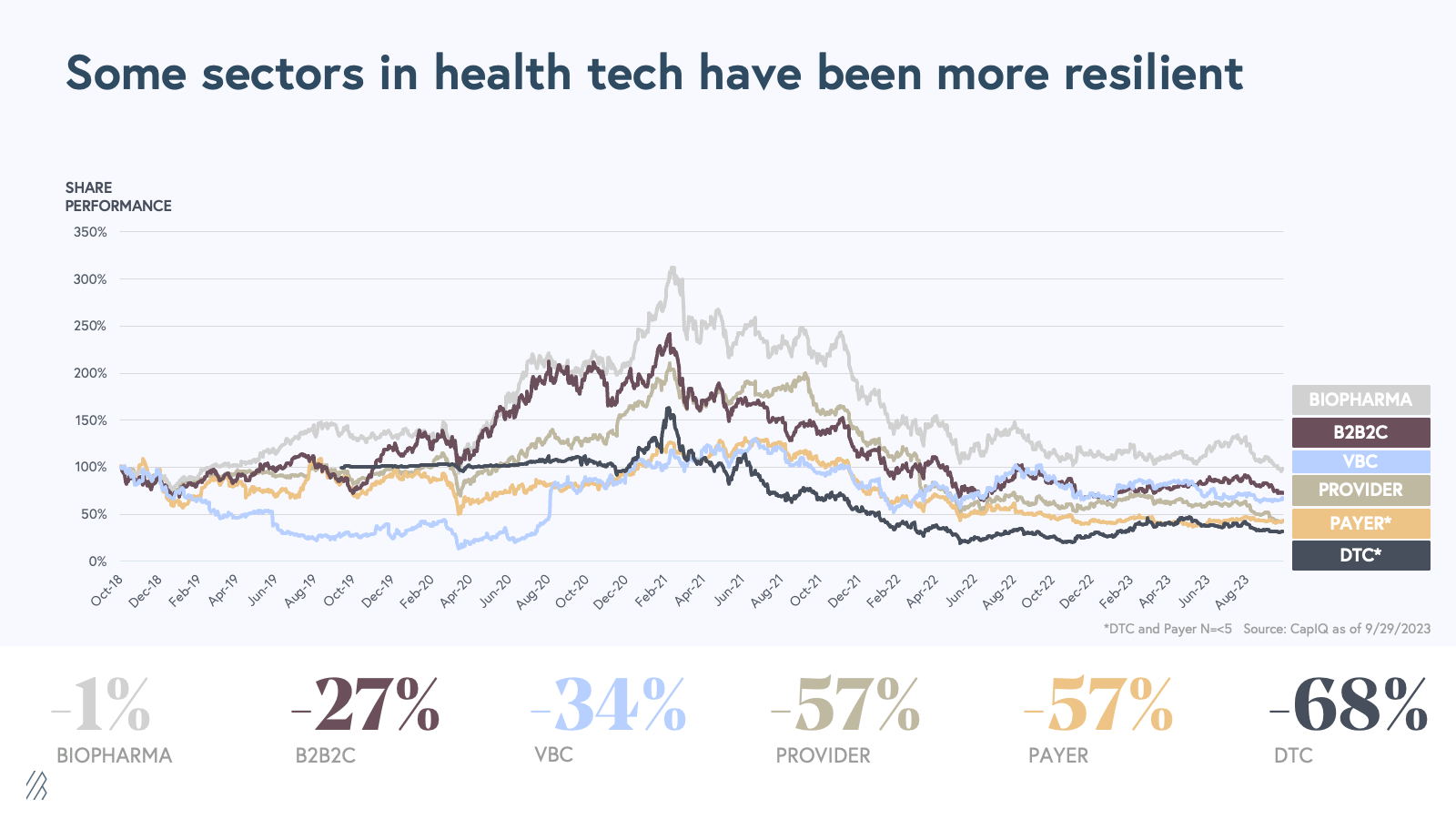

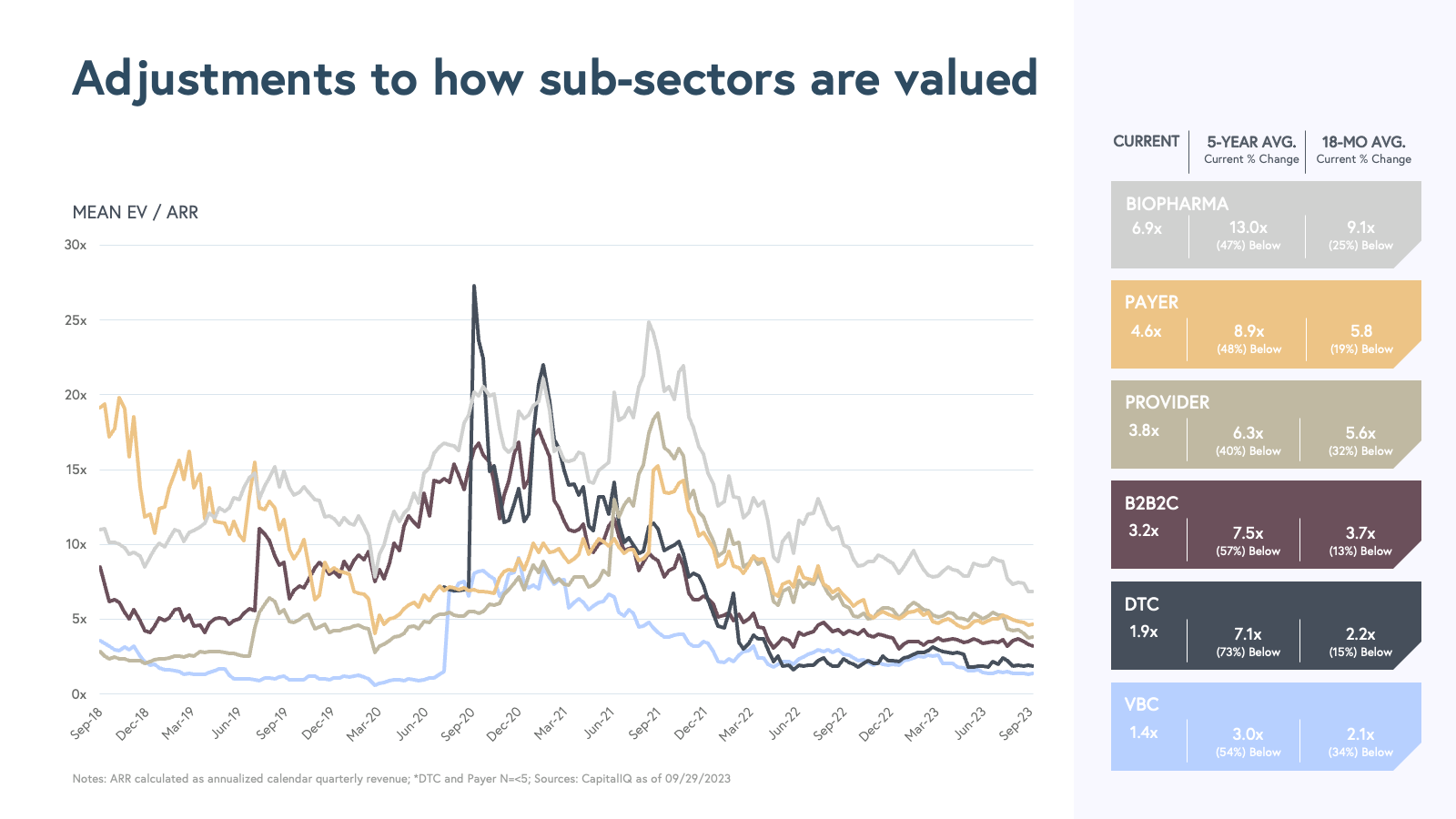

What health tech sub-sectors have been the most resilient in the public markets? We split the 32 stocks in the health tech cohort: we categorized healthcare SaaS into Payer, Provider and Biopharma sub-sectors and tech-enabled services into B2B2C, Value-Based Care (VBC), and Direct-to-Consumer (DTC) (See our methodology for a list of stocks in each sub-sector). In healthcare SaaS, the Biopharma sub-sector only declined 1% whereas Payer and Provider software declined 57% in value. In tech-enabled services, B2B2C only declined 27% whereas DTC lost 68% of value.

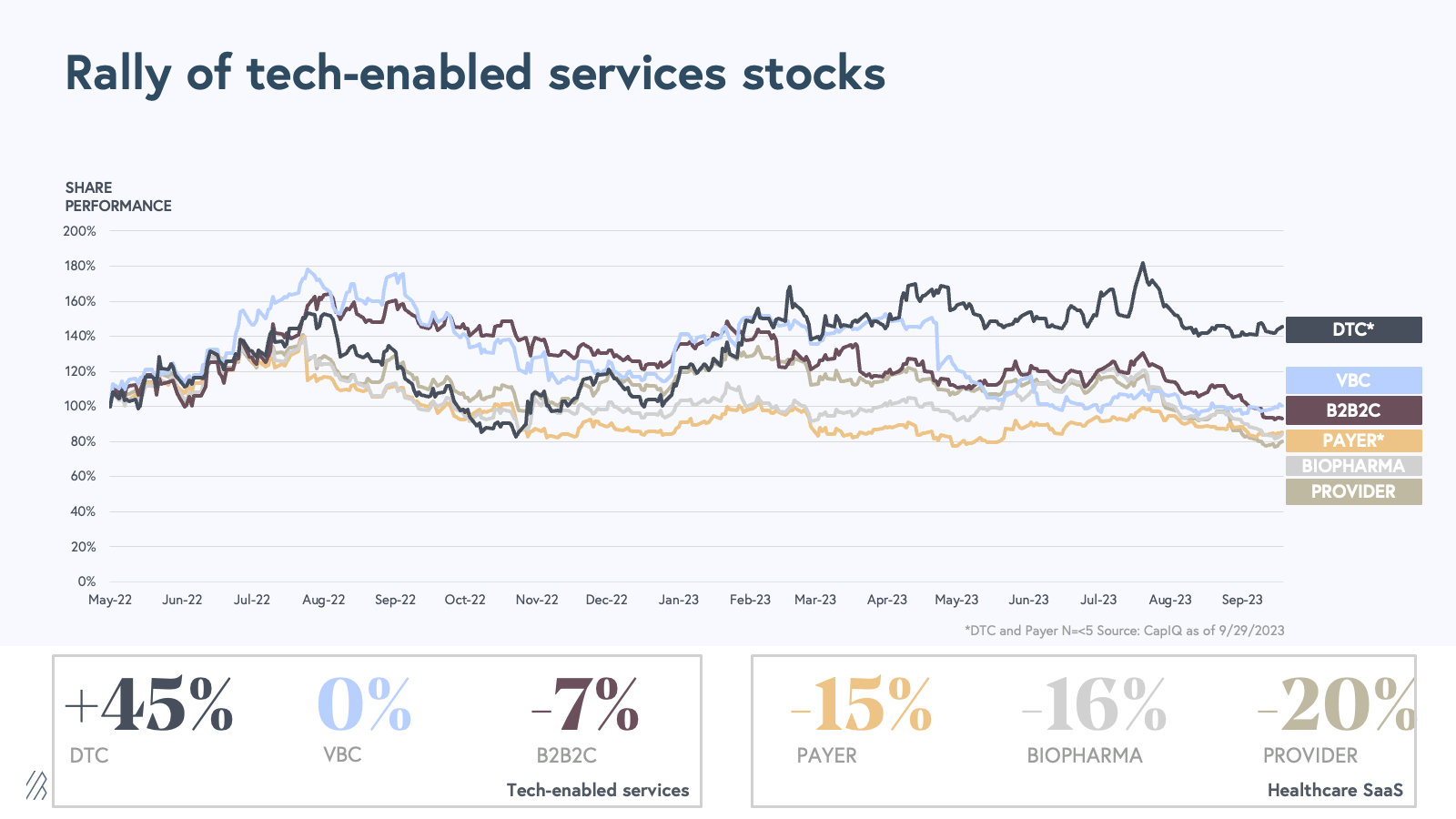

Now if we look at the same trough period, since May 2022, we see that the tech-enabled services sectors have been flat-to-improving in share performance, whereas the three healthcare SaaS sub-sectors have seen approximately a 15-20% decline in share price.

If we look at the sub-sectors by revenue multiples, we see a wide range, with Biopharma commanding the highest valuation multiples, and VBC and DTC the lowest. Given the varied unit economic profiles of the tech-enabled services businesses, we are finally moving away from revenue multiples.

It is clear that in the last few years, hype outpaced reality, and widespread disillusionment is a standard part of any hype cycle. A similar reckoning has impacted the private markets, which have lagged the public market readjustment by a few quarters. The state of health tech today raises questions about which business models are most resilient and how the health tech industry can make it out of the trough of disillusionment and into a new phase of “enlightenment.” Despite the recent market challenges, we see three silver linings:

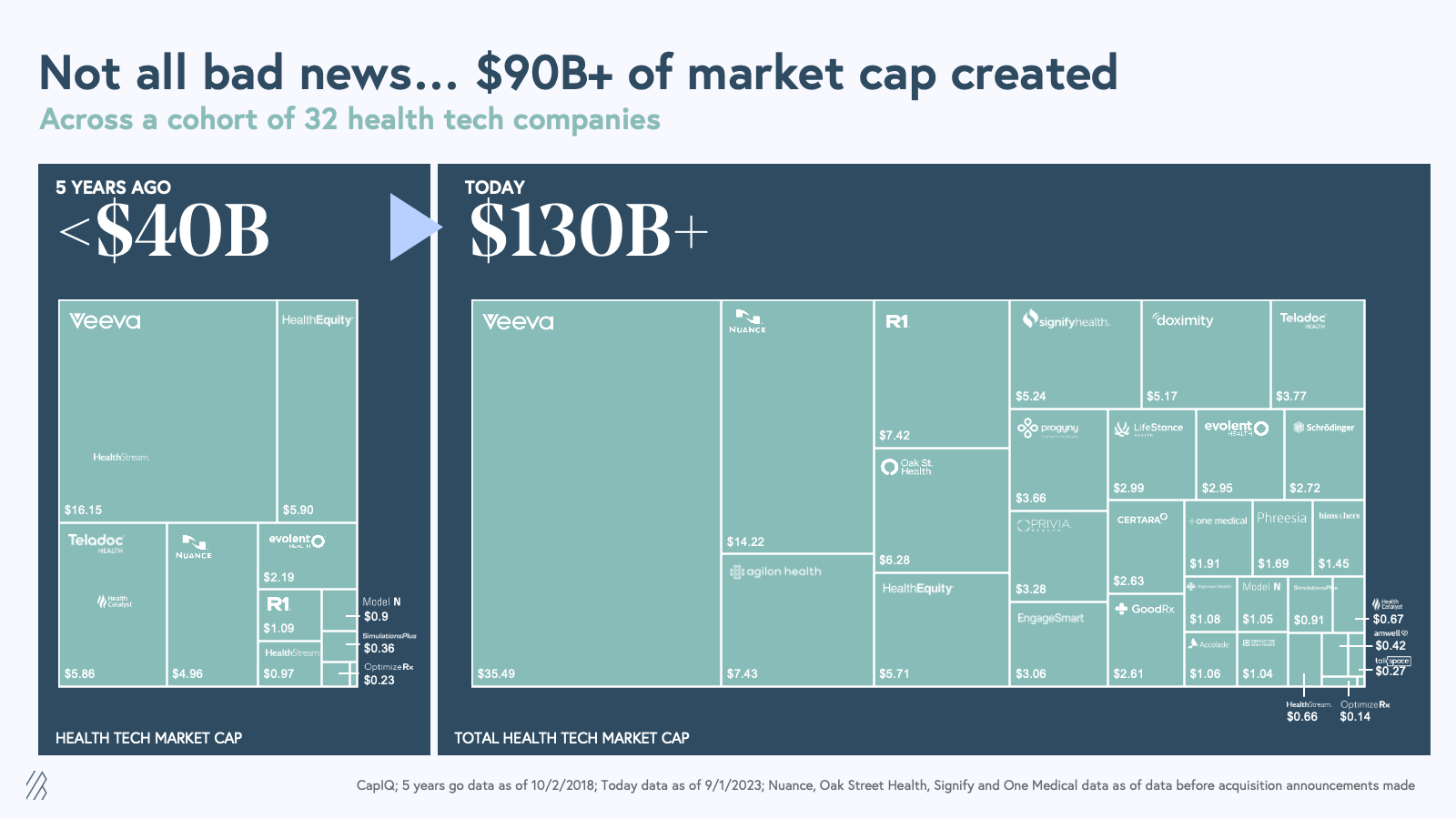

First, the health tech sector has generated over $90 billion in public market cap in the last five years. Notably, companies like Veeva, R1, Nuance, Model N, and Simulations Plus experienced significant growth in market cap since October 2018. In addition, most of this growth in market cap stems from a new cohort of 19 companies that have gone public during this period. Below is a picture of the 32 health tech companies in our health tech cohort we studied and their market sizes five years ago and today.

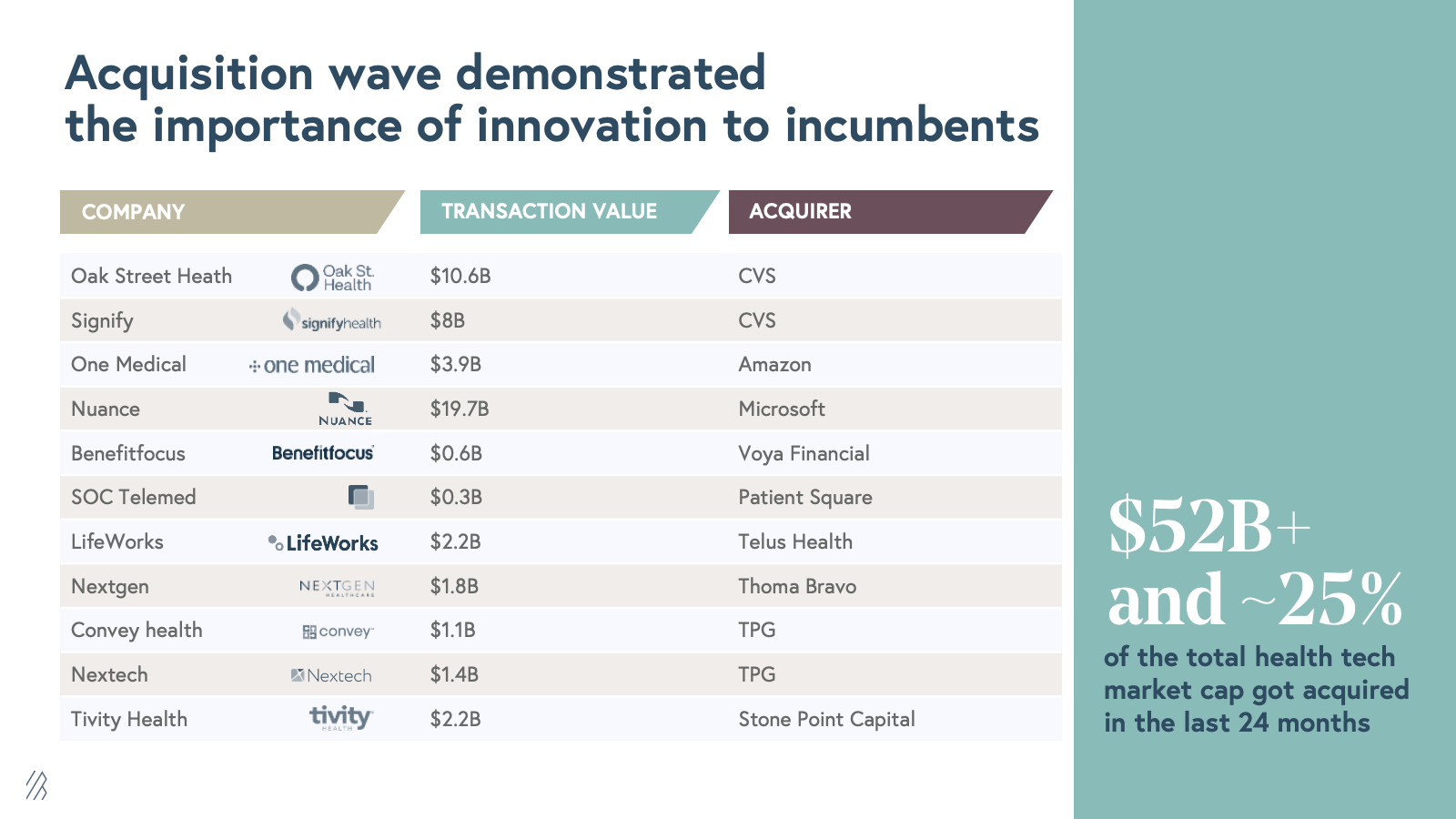

Second, the contraction in valuation multiples has triggered a surge of acquisitions, as healthcare incumbents become increasingly aware of the need to innovate through strategic deals. Our analysis indicates that in the past two years, approximately $52 billion—representing nearly a quarter of our health tech cohort’s total market capitalization—has been acquired. Although purchasers are still paying premiums to current market capitalizations, these premiums are less exorbitant than those we saw at the 2021 valuation peak. Many of the companies during this period are value-based care enablement companies, representing progress toward more efficient care delivery. Similar patterns of consolidation and acquisition have been observed in other innovative markets, such as cloud technology, particularly around 2016.

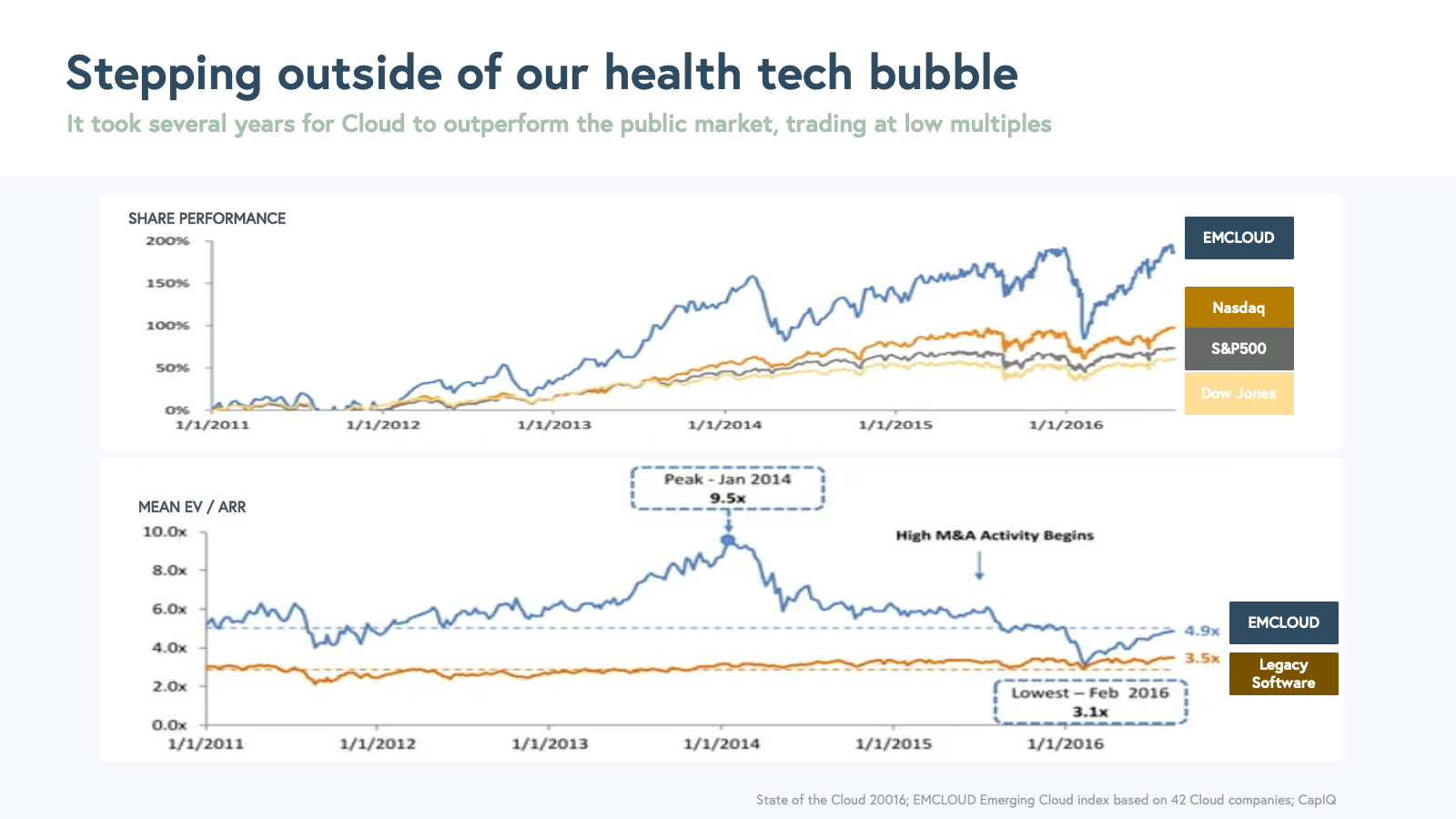

Third, the story of the rise of the cloud market (which made its public market debut a decade before the health tech industry) offers extra reason for hope—it took several years for the Emerging Cloud Index to surpass broader market indices, even through a bull market and subsequent corrections in 2014 and 2016. Additionally, in these early innings, cloud companies traded at relatively modest revenue multiples—averaging 4.9x over a five-year span beginning in 2011— and far from the peak of 27x EV/ARR in 2021. Today, Cloud has corrected and trades at about 7.5x EV/ARR multiples more in line with historical norms. A key question for the health tech industry is, “What multiples are the norm?”, as we are still in the early years of this journey. It takes time for the market to understand how to value these companies.

Importantly, it took some time for software businesses to refine and repeat the software-as-a-service model, but once they did, more cloud companies went public—the same dynamic could drive health tech listings, too. In January 2011, our colleagues at Bessemer tracked <5 public cloud companies. Five years later, in 2016, the cohort grew to 42, and today there are 55 companies in the EMCLOUD index. Which health tech companies will go public next, and do their business models show repeatable fundamentals that scale?

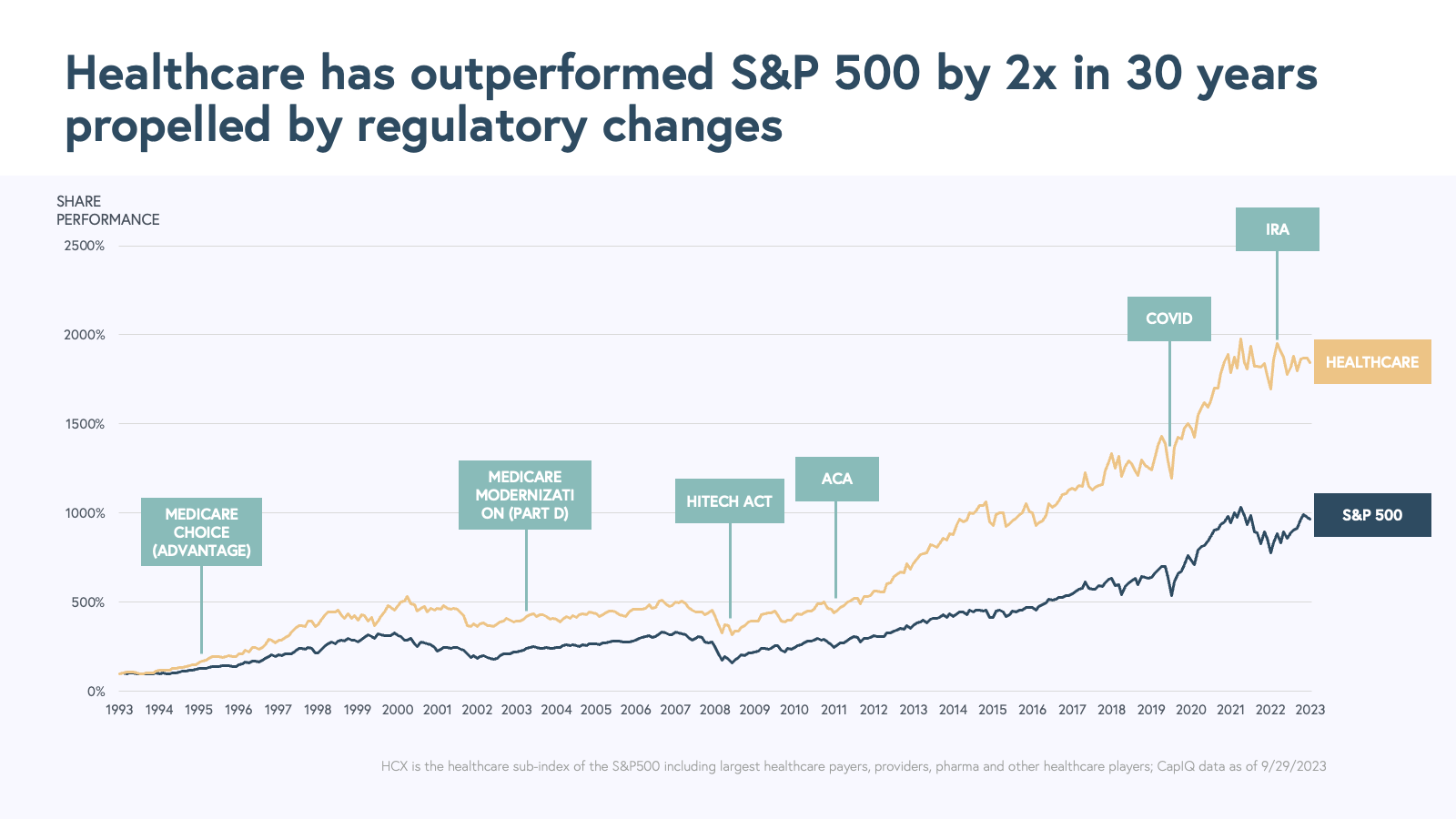

Let’s also not forget about the healthcare industry’s overall performance. The S&P 500 Health Care sub-index (HCX) has outperformed the overall S&P 500 by ~2x over the last 30 years. This index includes the largest healthcare payers, providers, pharma, and other healthcare players. While healthcare is generally thought to be more resistant to economic cycles, it appears that the real alpha in the HCX has occurred during times of regulatory change, such as the initiation of Medicare Advantage in 1995, the HITECH Act in 2008, the Affordable Care Act in 2010, and the COVID-19 pandemic in 2020.

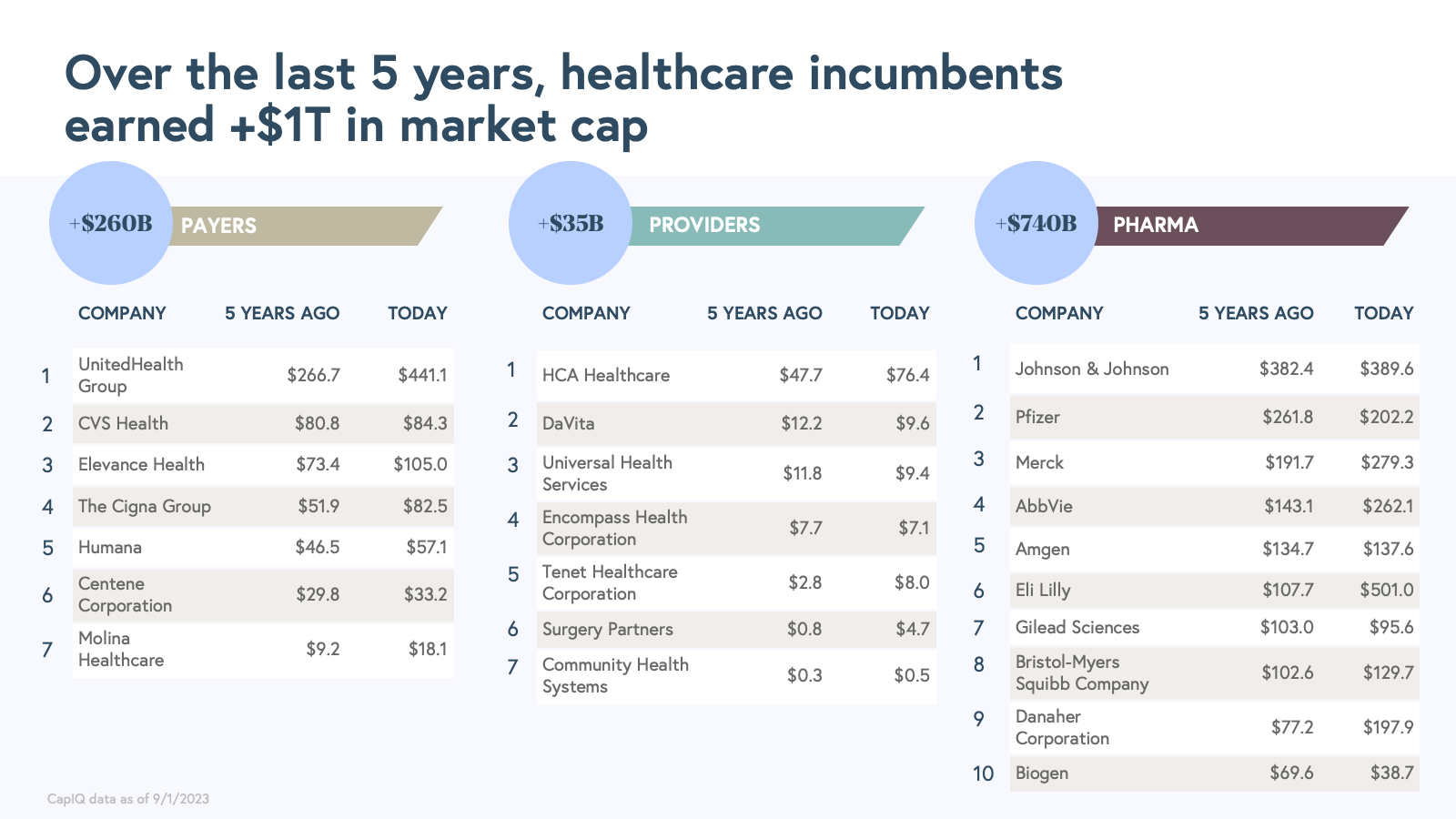

We believe regulation has been the bellwether of our industry, with the ACA and HITECH Act serving as stepping stones to the birth of many great health tech companies. Yet the performance of the HCX index reveals that the largest healthcare incumbents have accumulated over $1 trillion in market cap in the past five years, with pharmaceutical companies leading the pack, followed by healthcare payers and providers. This raises the question, why has most of the value in the healthcare industry accrued to incumbents? And how do we make sure the health tech and innovation ecosystems thrive alongside incumbents?

The past three years post-COVID have revealed systematic gaps and empowered patients to take a more active role in their care. We continue to see a need for more workflow digitization, consumer empowerment, and value-based and cost-effective care delivery. We believe great entrepreneurs will take advantage of opportunities opened by regulatory changes. Pivotal questions remain: Will technology serve as a significant driver of change, as it has in virtually every other industry? And will its adoption and shifts in business models enable incumbent players to sustain enduring returns over the long-term?

We discussed in prior articles (here and here) that health tech businesses can be attractive to investors, but that they take longer and more capital to achieve meaningful scale compared to software counterparts. So, is it worth it for founders and investors? Are all health tech businesses capital-intensive and impossible to scale profitably, or did investors overvalue them during the recent peak? Our analysis suggests it’s likely a mix of both.

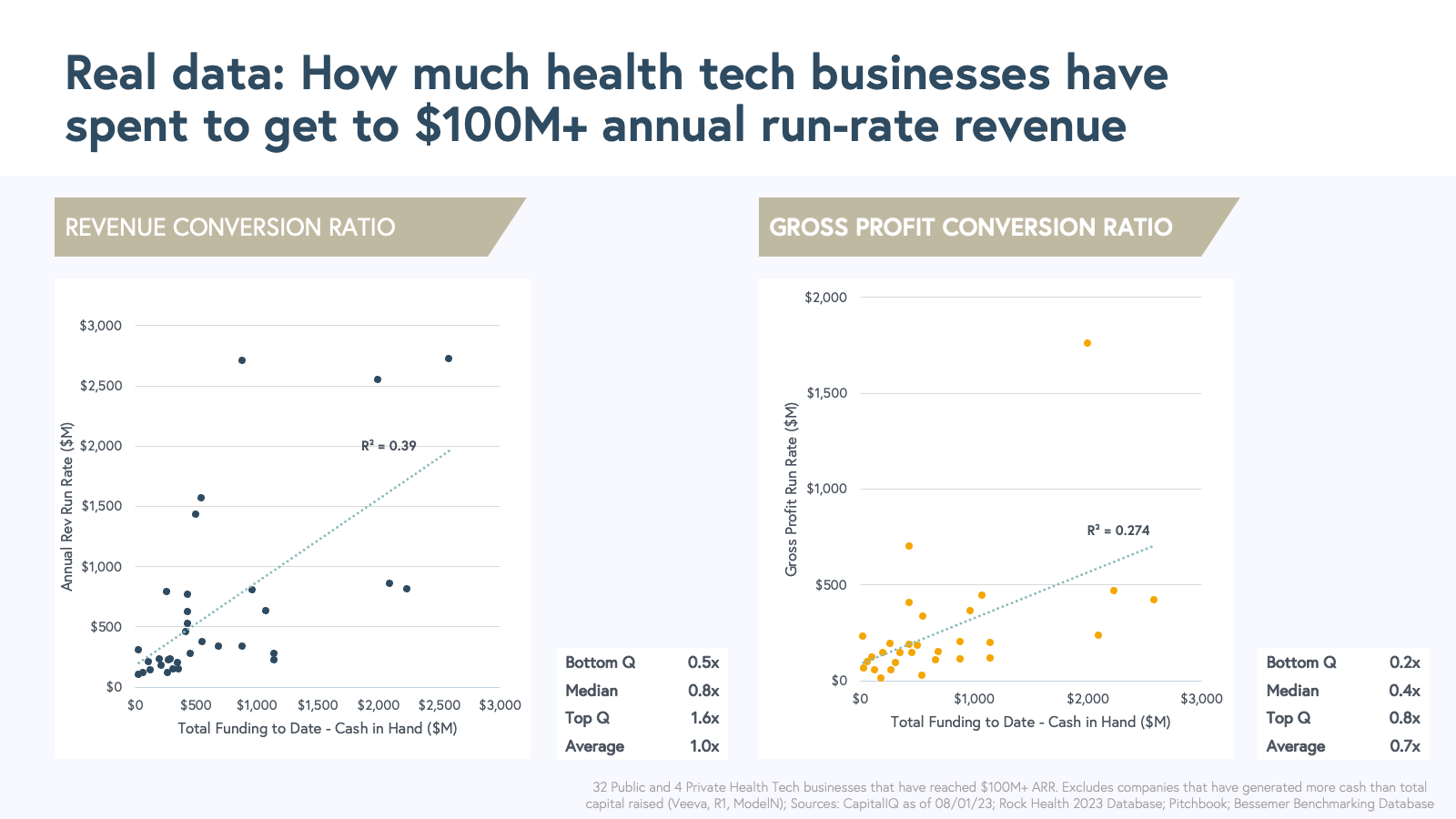

We examined 36 health tech companies with over $100 million in annual revenue run rate—the 32 publicly traded companies we mentioned, as well as four private companies—to understand capital efficiency. Compared to traditional SaaS companies, the median health tech company needs more capital to reach the $100 million revenue milestone. However, on average, the revenue-to-capital burned ratio is similar at 1x.

Not all health tech revenue is created equal. For example, value-based care companies grow to multibillion-dollar top-line revenues but only have an average of ~15% gross margins. Given the variability in gross margins across healthcare SaaS and tech-enabled services, we adjusted for gross profit run rate and total burn. The top quartile generates $0.8 of gross profit per dollar burned, aligning with our expectations for high-margin (65%+ gross margin), best-in-class tech-enabled services. On the other hand, the bottom quartile generates only $0.2 of gross profit per dollar burned, which leaves little room for “below the line” operating expenses and makes reaching profitability challenging for even the most outstanding operators.

Only three of the companies we studied—Veeva, R1, and ModelN— have generated more cash than they raised, which admittedly is concerning for our industry, but we hope more will join this category as there are 13 other companies in our dataset that have reached positive free cash flow (FCF) margins today.

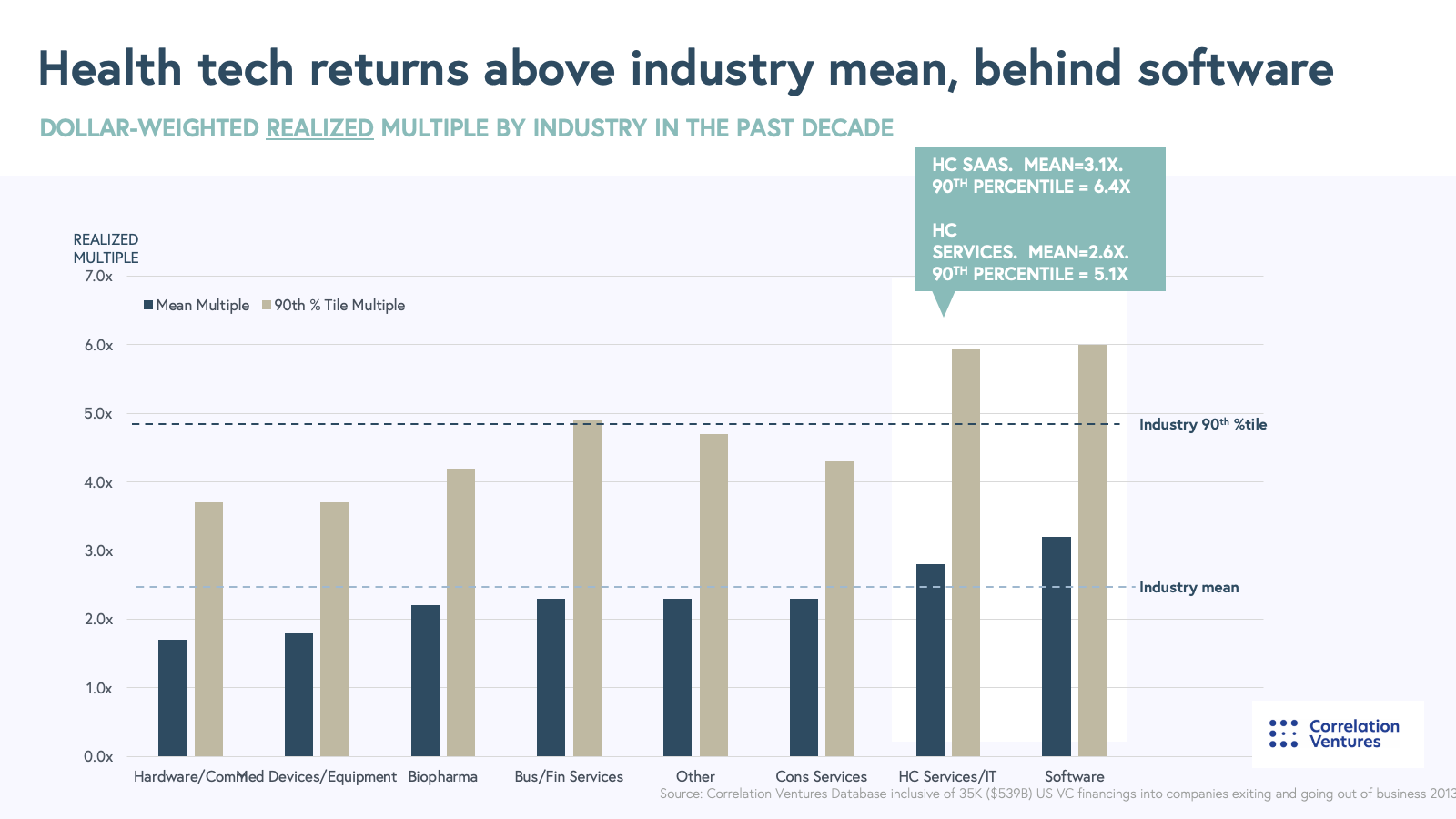

Using data from 35,000 VC financings across industries that our colleagues at Correlation Ventures assembled, we looked at dollar-weighted realized returns over the past decade as a proxy to understand investor returns in health tech companies. We see that health tech is the second best performing sector just behind Software. Healthcare SaaS companies have average returns of 3.1x (90th percentile = 6.4x), and healthcare services businesses have average returns of 2.6x (90th percentile = 5.1x).

However, the exuberance of the last three years may affect the returns of the private companies that are still in the growth stage and likely due a market correction. In our public playbook analysis in August 2022, we highlighted that the public and private markets misunderstood and misvalued tech-enabled services, focusing too heavily on revenue multiples.

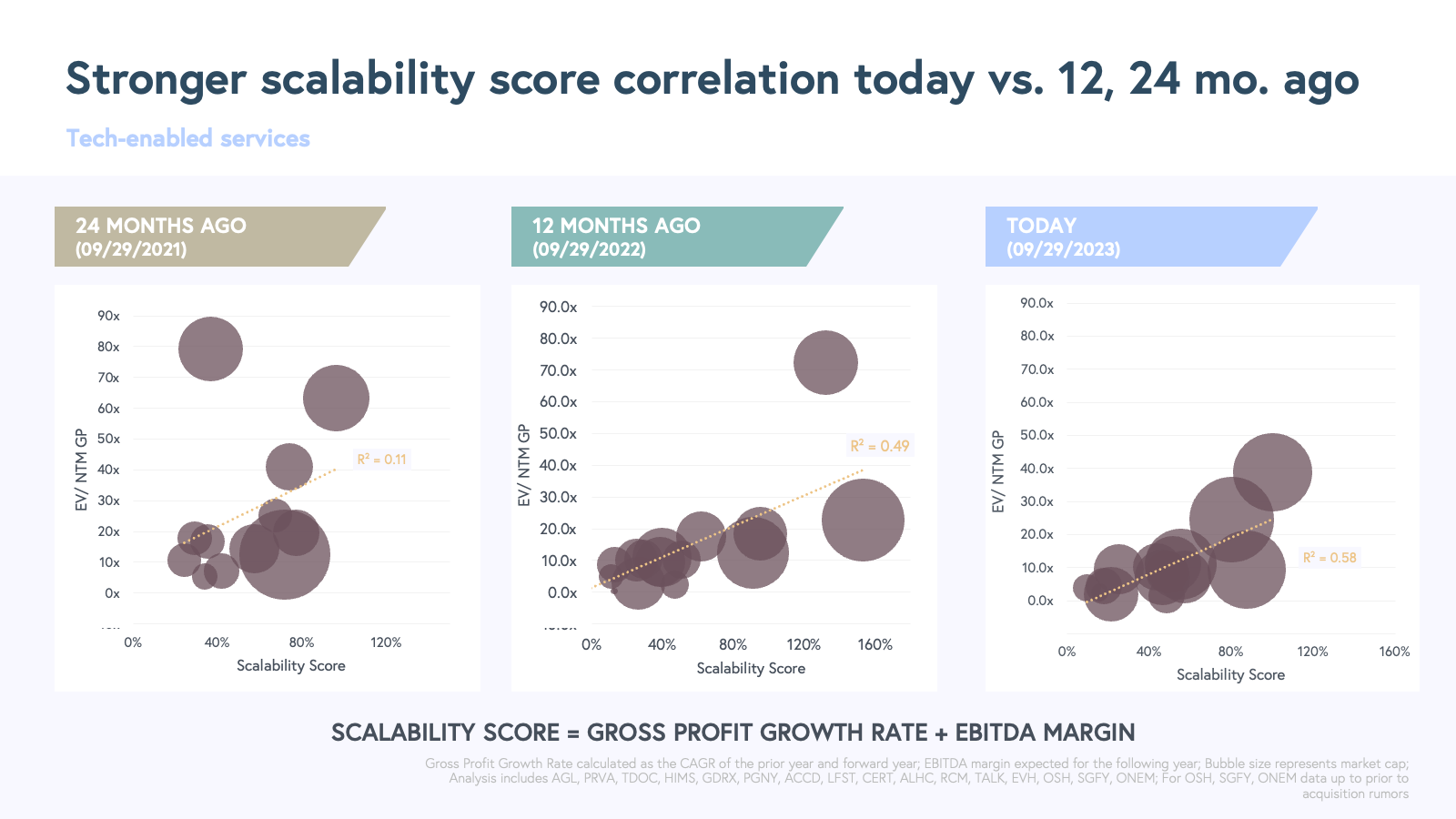

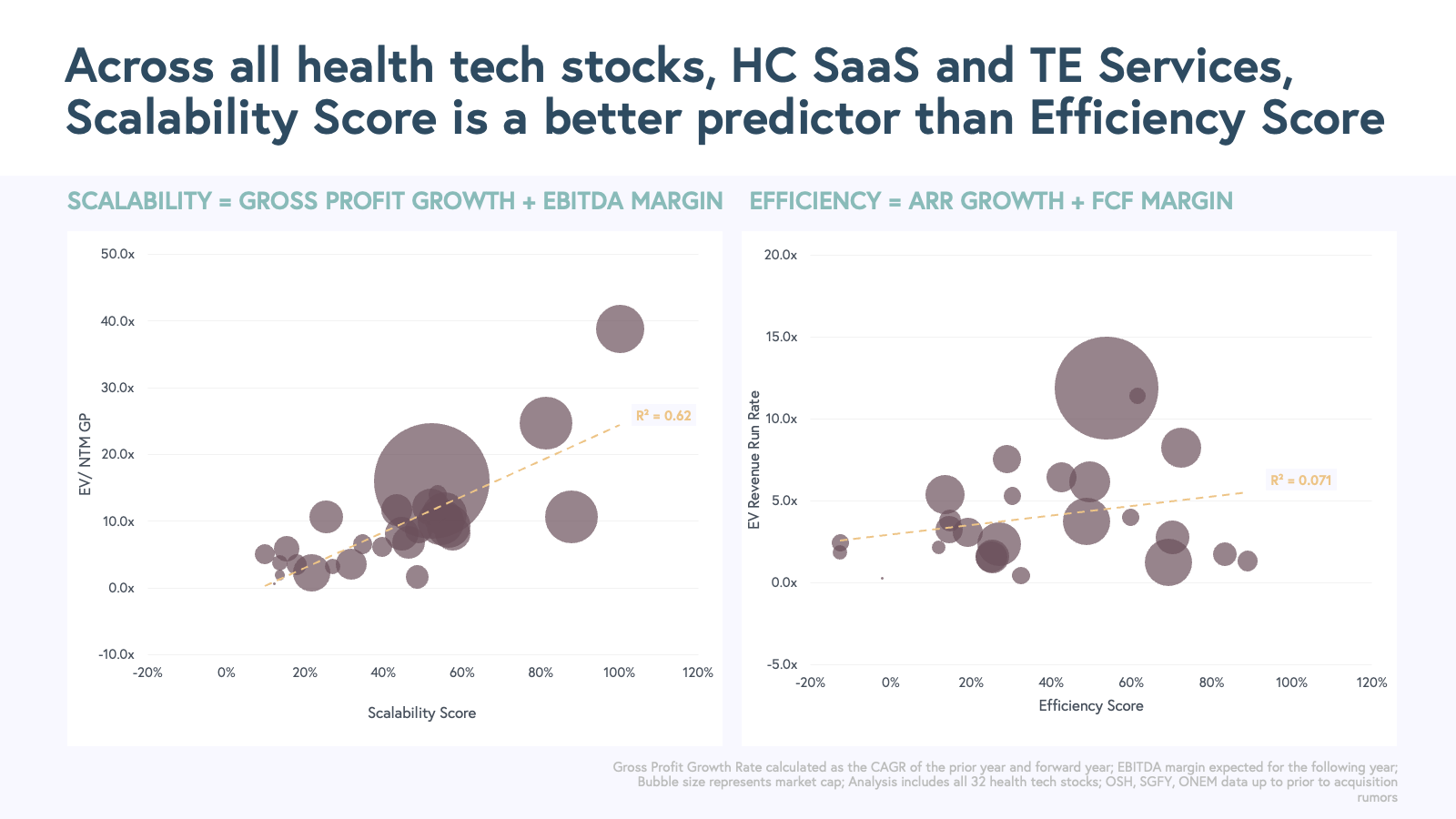

Scaling an enduring business requires a delicate balance between high growth and profitability. To marry these two, we suggested moving away from revenue multiples and looking instead to gross profit. We offered a new metric—scalability score—to understand the balance of growth, unit economics, and profitability. To calculate scalability score, we added gross profit growth, (gross profit CAGR from the prior year and the forward year), and EBITDA Margin expected for the next twelve months.

In July 2022, we saw early signs of a correlation between how health tech businesses were being valued and their scalability score. Today, we see the correlation between valuations and scalability score strengthening.

We also observe a strong relationship between valuations and scalability scores when looking at both healthcare SaaS and tech-enabled services, away from the traditional efficiency scores used in SaaS. As a reminder, efficiency score is calculated the sum of growth in revenue run rate and free cash flow margin.

The shift in focus to scalable growth has trickled down to the private market, and we are hopeful that as founders, operators and investors make this pivot, a cohort of companies will reach scale with more profitable business models.

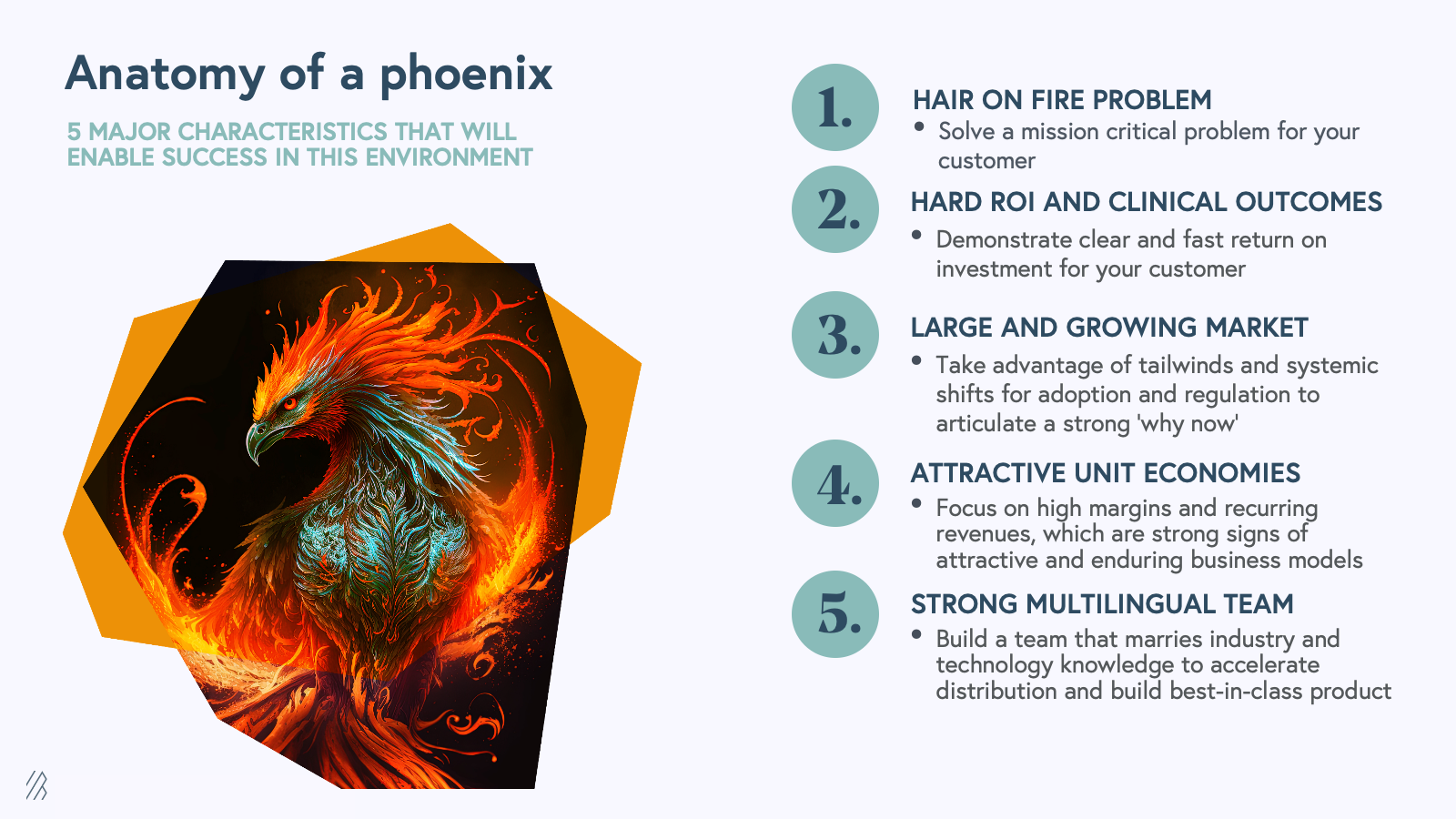

For health tech to reach the fourth stage in its hype cycle, the “slope of enlightenment,” the sector needs multiple startup success stories with sustained outcomes and scalable business models. Like phoenixes rising from the ashes, there will be several resilient companies with strong business models, sound leadership and just the right idea to come out on the other side of this market lull. So who is making it to the other side and who will be left behind in the digital health graveyard? We hope that the growth of efficient, resilient health tech businesses in the private markets will lead to a rise of new IPOs over the next few years. Let’s deep dive into what the phoenixes will have in common.

At earlier stages, the companies that will succeed and make it out of the trough of disillusionment will have five major characteristics in common:

- Hair on fire problem: Solve a mission-critical problem for your customer.

- Hard ROI and clinical outcomes: Demonstrate clear and fast return on investment for your customer.

- Large and growing market: Take advantage of tailwinds and systemic shifts for adoption and regulation to articulate a strong ‘why now’ for your opportunity.

- Attractive unit economics: Focus on high margins and recurring revenues, which are strong signs of attractive and enduring business models.

- Strong multi-disciplinary teams: Build a team that marries industry and technical knowledge to accelerate distribution, and build best-in-class product.

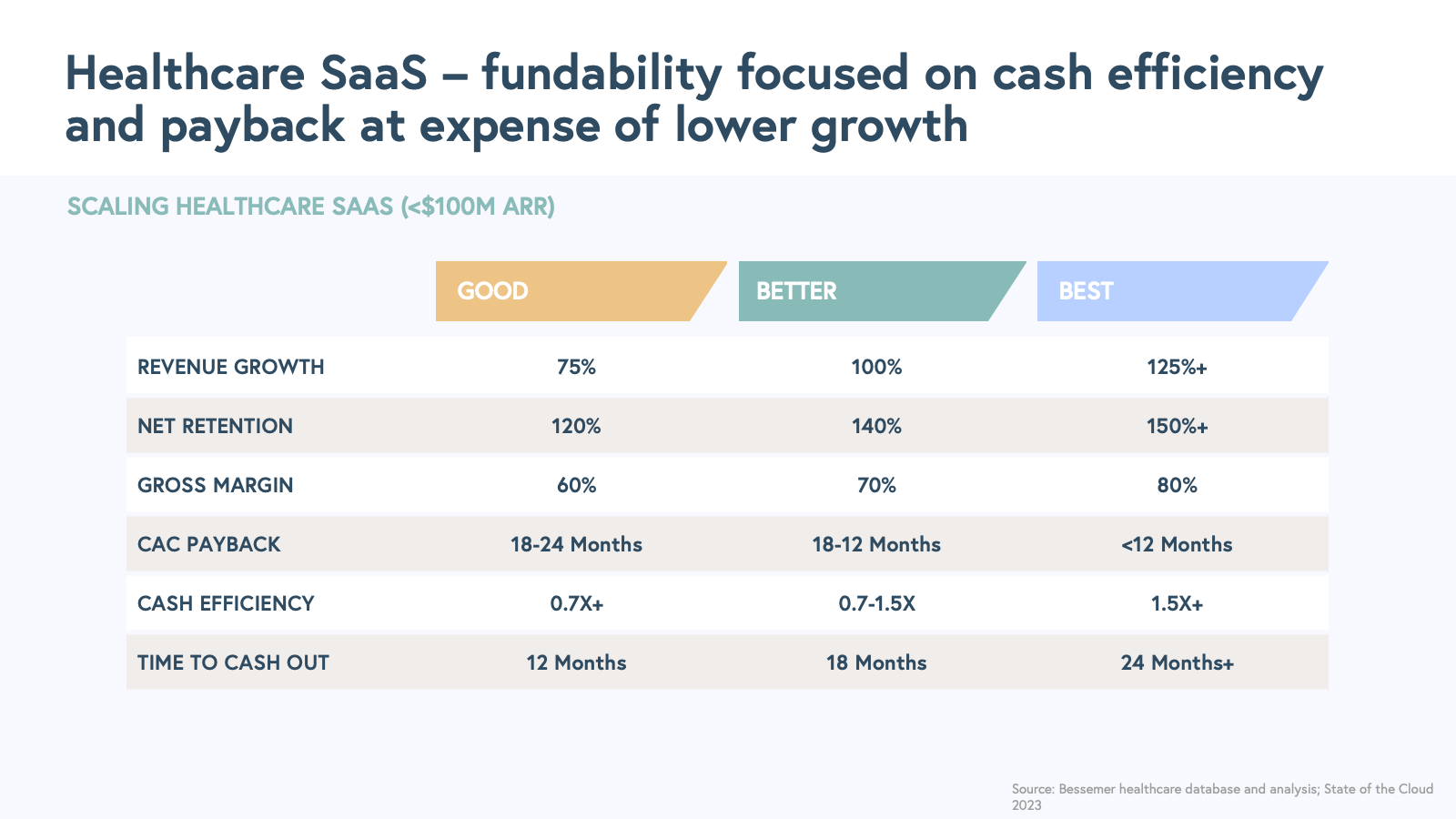

The bar is now higher to successfully raise funding. Below is a summary of “fundability” benchmarks for each business model. For more details about your company stage please review our Scaling Health Tech Businesses to $100M+ article. (We encourage companies to subscribe to Atlas and follow us on social media so you can be the first to know about our sub-sector benchmark deep dives coming out later this year.)

Healthcare SaaS benchmarks:

| Good | Better | Best | |

| Revenue Growth | 75% | 100% | 125% + |

| Net Retention | 120% + | 140% | 150% + |

| Gross Margin | 60% | 70% | 80% |

| CAC Payback | 18-24 months | 18-12 months | <12 months |

| Cash Efficiency | 0.7x + | 0.7x – 1.5x | 1.5x + |

| Time to cash out | 12 months | 18 months | 24 months + |

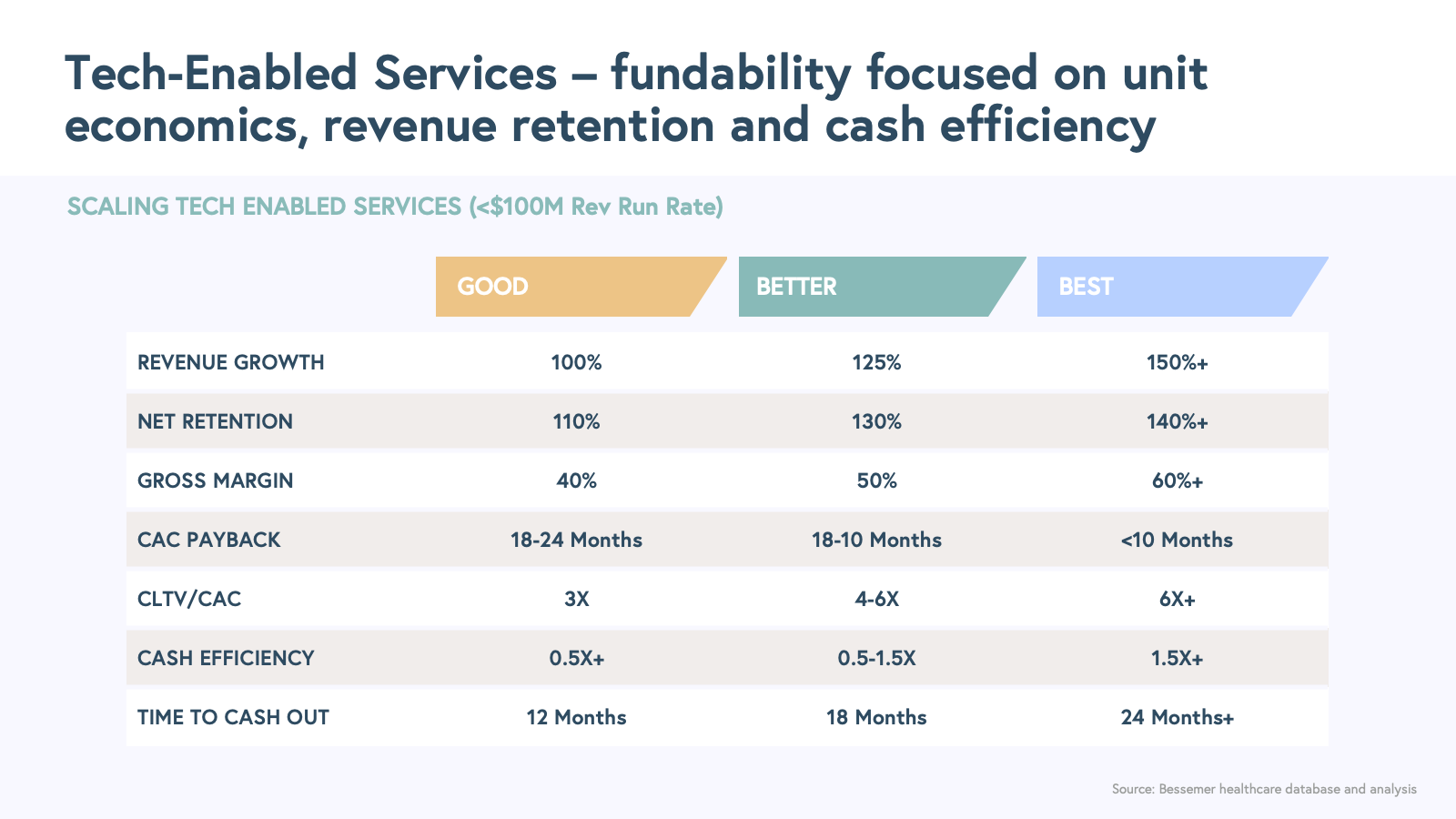

Tech-enabled services benchmarks:

| Good | Better | Best | |

| Revenue Growth | 100% | 125% | 150% + |

| Net Retention | 110% + | 130% | 140% + |

| Gross Margin | 40% | 50% | 60% + |

| CAC Payback | 18-24 months | 18-10 months | <10 months |

| CLTV/CAC | 3x | 4-6x | 6x+ |

| Cash Efficiency | 0.5x + | 0.5-1.5x | 1.5x + |

| Time to cash out | 12 months | 18 months | 24 months + |

As venture investors, we are always evolving our investment roadmaps by gathering feedback from healthcare stakeholders, as well as reviewing shifts in regulation that can create opportunities for innovation in business models and technology adoption. We would be remiss to not acknowledge the transformational impact that artificial intelligence is having in every industry, including healthcare (our team has covered it here and here). This is an early glimpse of where we see emerging changes in healthcare innovation occurring ahead of 2024.

Prediction 1. AI gives rise to Services-as-Software

We previously discussed that healthcare SaaS businesses are few and far between, accounting for only around 20% of healthcare IPOs and unicorns. Healthcare stakeholders are notoriously bad at adopting technology, which results in healthcare SaaS ventures facing extended sales cycles, cumbersome integrations, and challenges enforcing adoption among end-users. As a result, many companies pivot towards tech-enabled services and bespoke software point solutions. Advancements in generative AI and large language models (LLMs) are unleashing a flood of new software applications that deliver a service as the final product, as opposed to offering a workflow tool where the end user completes an action. These advancements have flipped the traditional SaaS model on its head, creating a new “Services-as-Software” paradigm. This shift offers health tech founders the opportunity to capture a larger market share without solely relying on healthcare IT budgets (<10% of $950 billion spend) by reimagining how they can provide solutions that were not possible in the past.

Rising costs, labor shortages across clinician and administrative staff, and the rise of physician burnout are creating a breaking point for the healthcare system. Over 80% of providers are shifting their strategies to use AI to address these inefficiencies, starting with administrative processes. Services-as-Software have the advantage of near-zero variable cost and are well-suited to deliver value in use cases that are people-intensive today, such as medical evidence summarization, chart audits, and claims reviews. To become category leaders, these platforms need to lean into moats based on data, integrations, or feedback loops.

One early application of services-as-software in healthcare is payments workflow automation, where AI/ML products help buyers drive revenue growth and make informed decisions based on clinical and financial data. Great examples of BVP portfolio companies in this space include SmarterDx, which is providing clinical review and quality audit of medical claims, and Abridge, which is helping with transcription and clinical note generation.

Prediction 2. Healthcare payments companies win by aligning incentives

The healthcare payments tech stack, better known as revenue cycle management, is rife with inefficiencies and misaligned incentives. This has resulted in duplicate systems and cumbersome manual processes that have ballooned administrative costs. We believe that there is an enormous opportunity for software to become the system of record and connective tissue between payers and providers, thus enabling a more transparent and efficient payment system. However, in order to succeed at this task, business models must intricately follow the money and align incentives between the stakeholders. We are excited about companies that can harmonize and deduplicate antagonistic systems, such as prior authorizations and utilization management, claims adjudication, payment integrity, and quality audits. Good examples in prior authorization include Verata Health and Cohere Health. These companies digitize and automate prior authorizations based on evidence-based protocols on behalf of payers, which in turn makes life easier for providers. Another example is Anomaly focused on precision payments.

Furthermore, we are excited about companies facilitating the transition to more risk-based payment models. For example, commercial payers are exploring new risk models, such as Individual Coverage Health Reimbursement Arrangements (ICHRA), and Consumer directed healthcare. We have seen companies like First Dollar building infrastructure to power the new payment rails. On the Medicare and Medicaid side, digitization of risk adjustment can help us move towards risk models while being compliant and transparent. Finally, there’s a crucial need for payment rails designed for value-based care, including standardized contracts and milestones, better outcomes tracking, aimed at alleviating the cash flow challenges often faced by healthcare services companies. Examples of companies include BVP portfolio company Turquoise Health, Accorded, and Syntax.

Prediction 3. Health tech businesses leverage indirect monetization for a distribution advantage

As the health tech investment landscape has grown more crowded and traditional sales channels have become saturated, it has been hard for businesses to gain a distribution advantage. However, we have seen a cohort of companies earn a distribution advantage by providing cheap or free software and service to their customers, thereby shortening their sales cycles. In turn, these companies are able to leverage indirect monetization strategies from day one.

For instance, Verse Medical focuses on durable medical equipment and monetizes through billing and payments, while our portfolio company Rupa Health operates a B2B2C marketplace for specialty diagnostics and generates income from supplier discounts and order fulfillment fees. Another example in our portfolio is HouseRx, which profits from specialty pharmacy scripts through distribution agreements with pharmaceutical companies. Doximity, a large-scale social network for healthcare providers, monetizes its platform by offering data and advertising opportunities to pharmaceutical companies.

These companies experience clear flywheel effects by monetizing different healthcare stakeholder touchpoints, which in turn strengthens their moat with scale and shorter sales cycles.

Prediction 4. Startups focus on making the biopharma value chain more efficient

Despite biopharma’s strong market performance during the height of the pandemic, the industry has faced headwinds in the current “risk off” environment while also continuing to grapple with increasingly complex challenges: R&D costs are up while sales forecasts are down, and drug discovery timelines remain lengthy and expensive (Eroom’s Law). Additionally, bipartisan efforts to reduce drug prices, including Medicare drug negotiations in the Inflation Reduction Act, have intensified pressures on biopharma executive teams. There’s a critical need for enhanced productivity across the value chain, with software and AI offering transformative solutions from drug discovery to commercialization.

In the drug discovery phase, we are looking for teams that can leverage AI to expedite new target discovery, enable more efficient design and discovery processes, and even computationally identify therapeutics that can “drug the undruggable” in ways that would be nearly impossible with standard drug finding campaigns, such as our portfolio company Peptone. Like Peptone, where the mission is to use computational design as a platform to create a robust and differentiated full-stack biotech pipeline, Seismic Therapeutic, Generate Biomedicines, Evozyne and Profluent are other great examples of what we call “TechBio Mullets”. These companies often leverage generative models to “generate” unique protein sequences that are designed to achieve specific efficacy, safety and drug property goals. We have also seen software platforms selling into pharma and biotech research teams that can enable more efficient target discovery and help model fine tuning and supercharge the power of scientists and bioinformaticians, like BVP portfolio company Watershed.

When it comes to clinical trials, we have written about how COVID served as a forcing function for development teams to adopt technology to run clinical trials remotely. Since then, several tech-enabled clinical trial organizations have grown, making research faster, cheaper, and more accessible through software. However, the complexity of trial protocols and the proliferation of point solutions and data are creating new opportunities for investment, including protocol digitization led by companies like Faro Health, and standardization of data lakes and insights like readout.ai and Lokavant. Lastly, we’re enthusiastic about companies like Mural Health in our portfolio, which streamline payments and contracts between trial sites and sponsors. These companies promote improved collaboration among clinical trial teams, researchers, and patients, leading to major efficiency gains in drug development.

In the commercialization stage, we see an opportunity to digitize sales by generating marketing collateral, monitoring regulations and compliance risks to drive productivity across commercial teams (Med Affairs, Finance, Patient Services, Sales, and Marketing). A few early stage companies in this space include portfolio company Rimsys, Lighthouse AI, and Nyquist. Finally, we believe there is an opportunity for software solutions to help with supply chain efficiencies, finance, and procurement optimization.

Although the first decade of the digital health industry has no doubt been choppy, we believe that there is a natural evolution of any innovation cycle and have seen similar ups and downs in many other sectors in which BVP invests. We believe our industry and the entrepreneurs we back are resilient. We are similarly hopeful that some of the insights gleaned from our analysis will be helpful as future entrepreneurs set out to build the next generation of healthcare companies.

We’re excited to continue to study the market and share insights on the State of Health Tech in the years to come. We would love to hear your feedback and ideas for other benchmarks and topics you would find useful for us to cover on the next one.

Methodology

Here are the 32 public health tech stocks we included in our analysis, broken down by sub-sector:

Healthcare SaaS

Pharma: SLP, DOCS, DH, HCAT, VEEV, SDGR, OPRX, MODN

Payer: HQY, DH, HCAT

Provider: CCLD, ESMT, HSTM, DOCS, DH, HCAT, NUAN, PHR

Tech-enabled services

B2B2C: TDOC, AMWL, PGNY, ACCD, LFST, CERT, RCM, ONEM, SGFY, LVGO

DTC: HIMS, TALK,GDRX

VBC: EVH, AGL, PRVA, ALHC, OSH

link