Where to invest: Healthcare, IT, financial services — top areas to look at for HNIs, says report

Client Associates (CA), one of India’s premier multi-family offices, has stated that the BSE 500 has historically delivered annualized returns of 13.85% during neutral market periods. In comparison, mid- and small-cap stocks have outperformed with returns of 14.06% and 17.40%, respectively, indicating the potential for strong returns even in volatile market conditions.

While the overall equity market may be facing a more cautious outlook in 2025, the report suggests that there are still opportunities for significant returns, especially within the large-cap stock segment. With assets under management exceeding $6.1 billion for over 1100 HNIs and Ultra HNIs, CA foresees a year of cautious optimism for Indian equities. The firm anticipates a 6.5% GDP growth for India, positioning the country as one of the fastest-growing major economies globally, despite a general slowdown in market growth.

According to Rohit Sarin, Co-Founder of Client Associates, the year 2025 will involve navigating a more cautious environment characterized by increased volatility compared to 2024. The company’s recent report highlights that despite the shift to a more unpredictable market setting, large-cap stocks present a compelling value opportunity, especially with their price-to-earnings (PE) ratio currently at 22—below the historical average of 24.2. On the other hand, mid and small-cap stocks, which have seen recent gains, are trading at higher PE ratios of 34.1 and 30 respectively, surpassing their five-year averages.

“While 2024 was marked by cyclical growth, we expect 2025 to be a year of strategic optimism,” said Sarin. “Sectors like healthcare, IT, and financial services are poised to drive long-term growth, even in a period of cyclical slowdown.”

Sectors to focus on

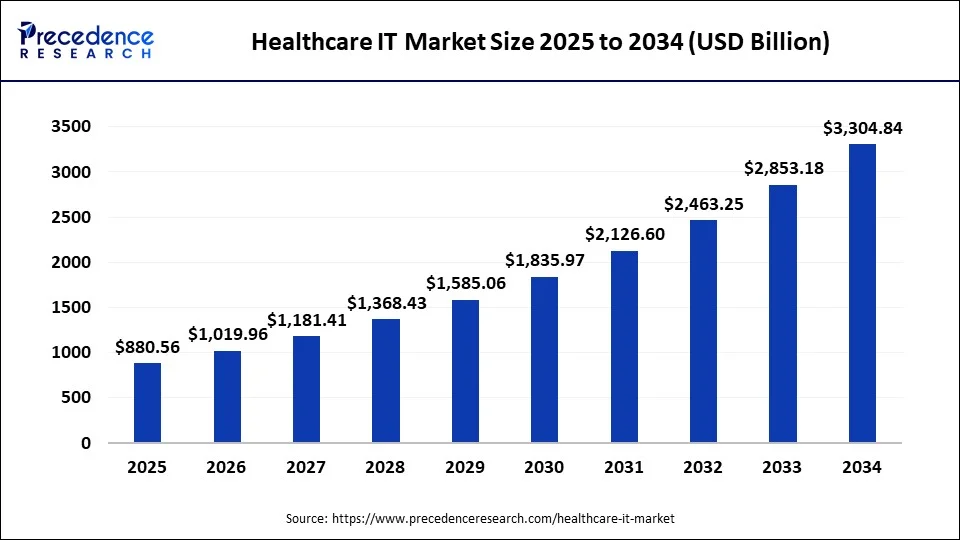

Client Associates has identified healthcare, information technology (IT), and financial services as key sectors to monitor in 2025. The healthcare industry is forecasted to grow by 19.9%, driven by a growing demand for specialized products and services. The IT sector is projected to experience a 12.9% growth, buoyed by advancements in artificial intelligence (AI) and a recovering global market. Financial services, specifically private banks and non-banking financial companies (NBFCs), are expected to demonstrate strong performance, benefiting from attractive valuations and increasing credit demand.

Slowdown in earnings

Client Associates anticipates a deceleration in earnings growth for Indian companies, with an estimated growth rate of 8.0% in FY25, a decrease from 20.1% in FY24. Nevertheless, the firm remains positive about a substantial recovery, as earnings growth is projected to bounce back to 11.7% in FY26. This medium-term perspective offers encouragement to investors seeking long-term gains amid temporary obstacles.

link